Most important, the partnership

assumes revenue visibility over the

long-term.

The organised player, adds capacity

at a lower investment of a greenfield/

brownfield expansion, gets additional

volume, increased revenue from

day one and moves closer to

the consuming markets which

mitigates increasing logistics costs –

strengthening business growth and

profitability.

Demand:

The Indian housing stock

accelerated in the last decade, with

urban stock growing at a healthy 4.1%

and catalysing tile industry growth.

The factors that catalysed tile industry

growth comprised the following:

Easier credit accessibility; tax

benefits in housing loans

Decline in the cost of tiles as a

proportion of housing costs

Increasing wealth and consumer

aspirations dovetailed with a widening

product range (superior to natural

stone)

The industry enjoyed an increasing

ROE despite inflation, marked by the

following:

Better assets-turnover ratio for

incrementally lower capex and the

industry moving towards bigger and

value-added tiles

Higher capacity utilisation to meet

growing demand

Growing preference for the JV

model (branded players partnering

with the smaller Morbi players)

Outlook:

The spread of roads,

telephones and electricity is helping

urban centres expand. As wage

growth remains strong, ‘new urban’

consumption goods (like tiles) are

expected to report robust demand.

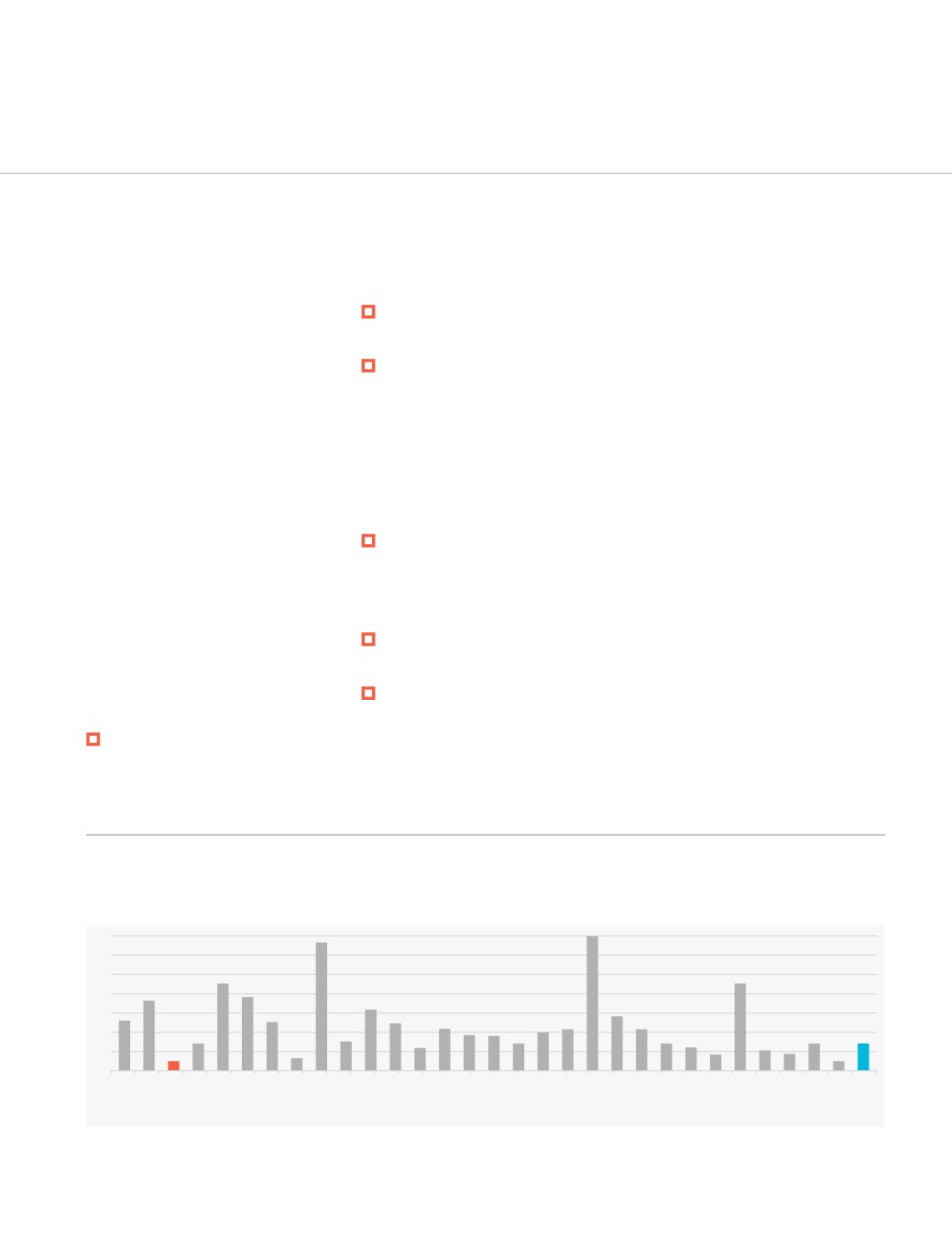

Despite a robust growth by the

organised tiles sector over the past

years, per capita consumption of

ceramic tiles in India is only a seventh

of Brazil’s, a sixth of China’s and a third

of Indonesia’s.

About 80%-85% of tile demand is

driven by new housing or first-time

users, while the balance is derived

from replacement. Interestingly, new

housing demand is expected to emerge

from non-metro locations (smaller

urban centres, Tier-II and III towns)

while replacement demand is expected

to be largely a metro phenomenon.

India has the lowest per capita consumption in the category dominated by emerging nations

Per capita consumption (sq. m) of tiles among the top 30 consumers globally

Note: for CY10. Source: Ceramics World Review, World Bank and Credit Suisse

In order of geographies with highest tiles consumption to lowest _>

7.0

6.0

5.0

1.0

2.0

3.0

4.0

0.0

China

Brazil

India

Indonesia

Iran

Vietnam

Egypt

USA

Saudi

Maxico

Spain

Italy

Russia

Turkey

Thailand

France

Germany

SKorea

Poland

UAE

Malaysia

Morocco

Argentina

Colombia

UK

Portugal

Ukraine

SAfrica

Algeria

Philipines

World

2.6

3.6

0.5

1.4

4.5

3.8

2.5

0.6

6.6

1.5

3.1

2.4

1.1

2.1

1.9 1.8

1.3

2.0

2.8

2.1

1.4 1.2

0.8

4.5

1.0 0.9

1.4

0.5

1.4

2.2

~13.3

29