Analysisof

financial statements

Despite the challenges of a slow-paced industrial sector and reduced investment

in housing due to a high interest rate regime prevalent during the majority of fiscal

2012-13, the Company recorded a higher topline, vindicating the effectiveness of

its business development strategies.

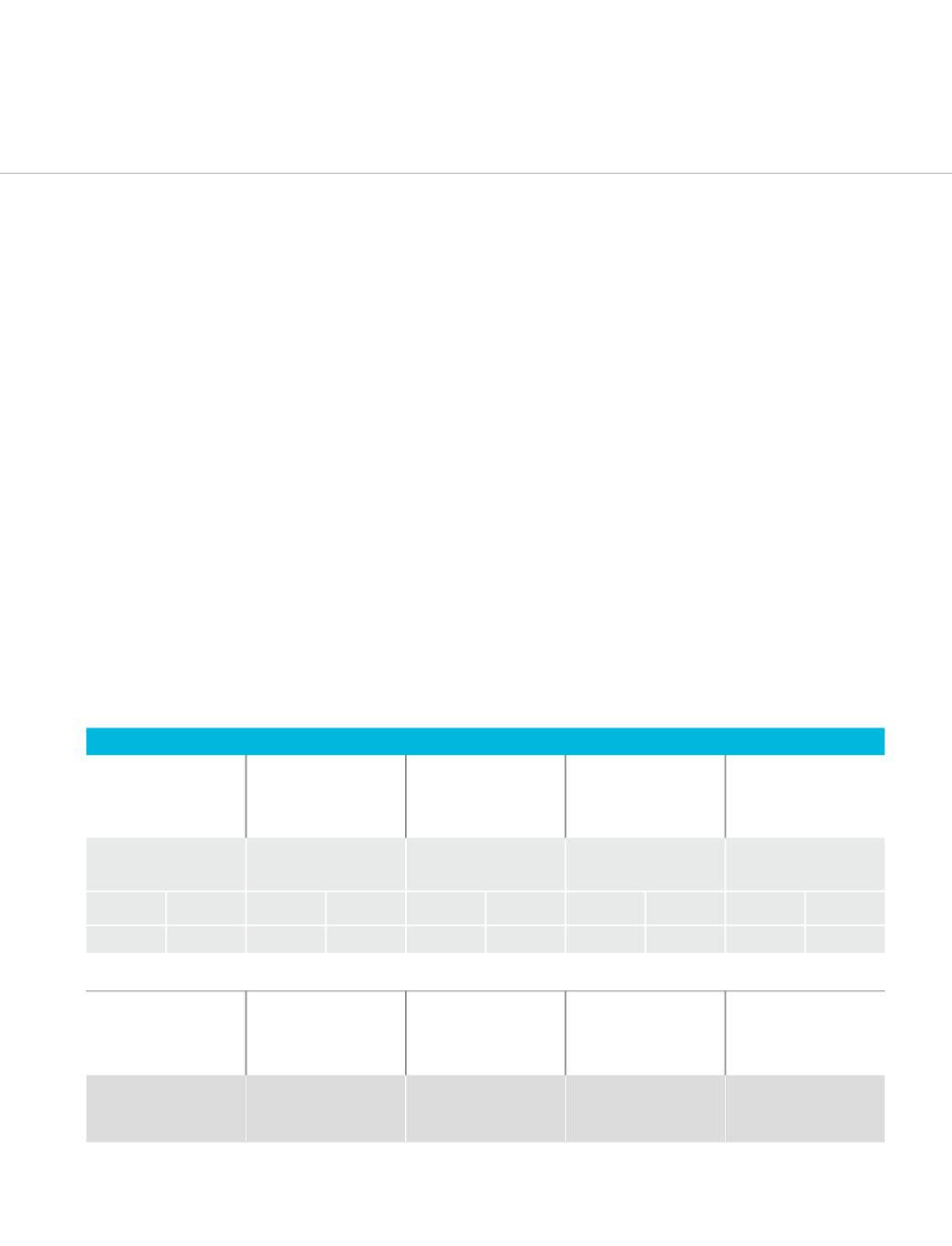

0.82

Debt equity

ratio

(March 31, 2013)

4.48

x

Interest cover

(2012-13)

32

days

Working capital

cycle

(March 31, 2013)

32.51

%

Return on networth

(avg.)

(March 31, 2013)

28.89

%

Return on capital

employed (avg.)

(March 31, 2013)

A) Profit and Loss Account

Revenue

Revenue grew 23% over the previous

year primarily due to the unfolding of a

volume-value strategy.

Volume growth:

Sales volumes

increased 15% from 39.75 MSM in

2011-12 to 45.62 MSM in 2012-13.

This increase was largely contributed

by the additional capacities of Cosa

and Vennar which commenced

operation during the year under

review. The Company’s plants at

Sikandrabad and Gailpur operated at

optimum capacity.

Value addition:

The team’s continuous

efforts in moving up the tile value-

pyramid strengthened realisation and

made an important contribution to the

Company’s growth. The contribution

from large-sized and digitally printed

tiles in ceramic and vitrified tile

segments increased this year. Besides,

the sale of double-charge polished

vitrified tiles from the Cosa unit added

to the Company’s value-addition

matrix.

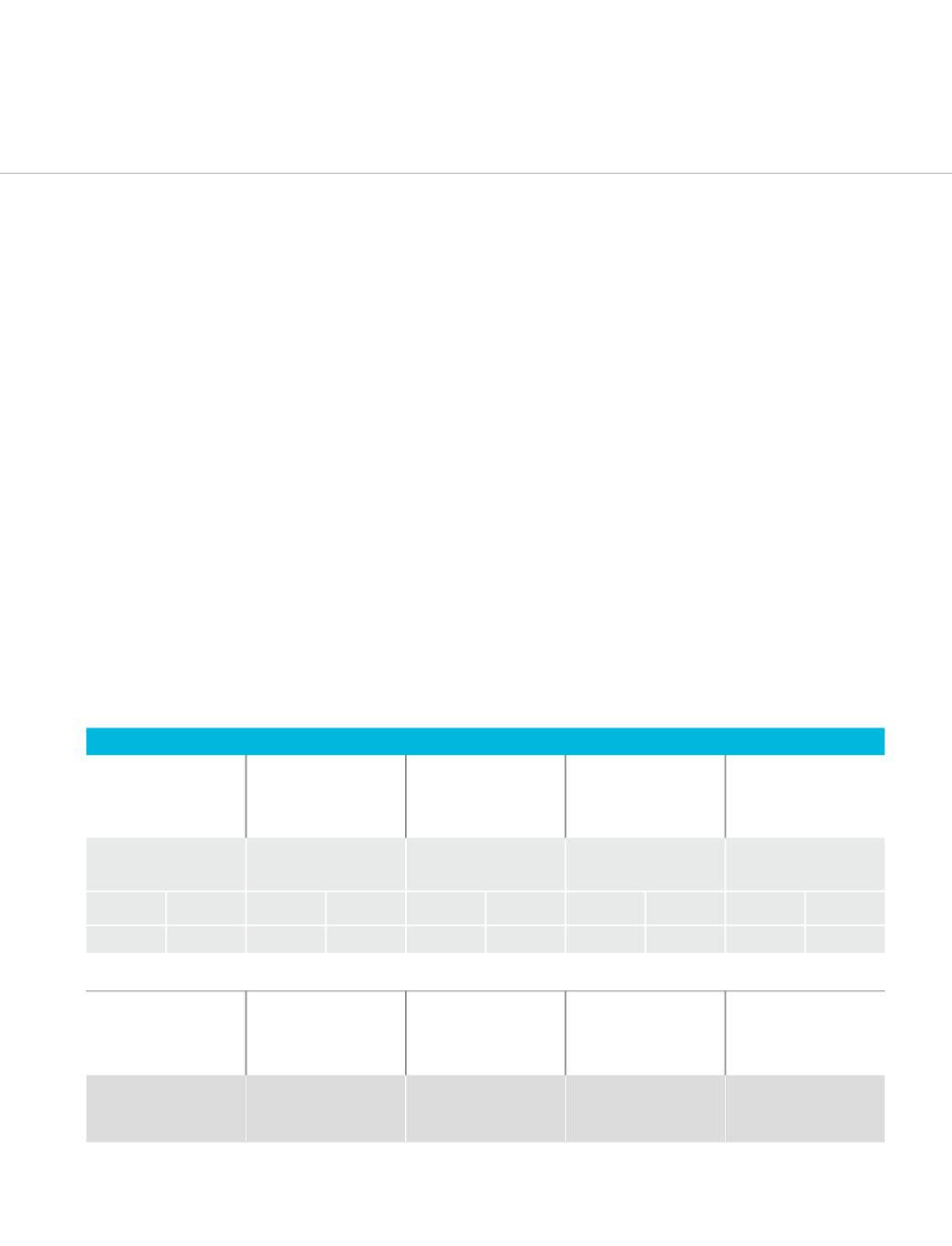

23

%

Net sales growth

(

`

million)

13115

2011-12

16109

2012-13

2077

2011-12

2477

2012-13

809

2011-12

1045

2012-13

1201

2011-12

1491

2012-13

10.99

2011-12

14.20

2012-13

19

%

EBIDTA growth

(

`

million)

29

%

Profit after tax growth

(

`

million)

24

%

Cash profit growth

(

`

million)

29

%

Earning per share growth

(

`

)

Snapshot

35