efficient operations management and

an entrenched marketing presence

enabled the Company to derive the

maximum returns from these inorganic

initiatives. The capital employed has

been calculated as per Table A below.

As a result, the Company’s ROCE grew

93 bps from 27.96% as on March 31,

2012 to 28.89% as on March 31, 2013.

Shareholders’ funds

Shareholders’ funds increased 28%

from

`

2,820.71 million as on March

31, 2012 to

`

3,608.78 million as on

March 31, 2013 owing to an increase

in ploughback of business profits.

As a result, the reserves and surplus

balance grew 29% from

`

2,673.54

million as on March 31, 2012 to

`

3,461.61 million as on March 31,

2013. The equity capital remained

unchanged at

`

147.17 million – the

promoters holding 53.51% of the

Company’s equity (March 31, 2013).

Shareholders’ fund as a proportion of

capital employed, stood at 46.61% as

on March 31, 2013 against 44.64%

as on March 31, 2012. The book value

per share climbed from

`

38.33 as on

March 31, 2012 to

`

49.04 as on March

31, 2013.

External debt

The Company’s debt portfolio

expanded from

`

2,781.92 million as on

March 31, 2012 to

`

3,201.66 million

as on March 31, 2013. This increase

was largely due to the new joint-

ventures of the Company with other

tile manufacturers. On a standalone

basis, the Company’s debt declined

by

`

253.41 million due to reduction

in long term debts. There is no foreign

currency loan outstanding as on March

31, 2013.

Despite the increase in absolute debt,

the debt-equity ratio declined to 0.82

as on March 31, 2013 from 0.96 as on

March 31, 2012.

As per the new regulatory guidelines,

Schedule VI (‘Balance Sheet’) grouping

has been altered. Total debt is reflected

in the Balance Sheet under the various

heads as per Table B below.

Fixed Assets

The continuous acquisitions spree

has been primarily responsible for

the addition to the gross block in

the last 12-18 months. In 2012-13,

the gross block increased by 17%

from

`

7,826.60 million as on March

31, 2012 to

`

9,194.50 million as on

March 31, 2013 due to routine capital

expenses and acquisitions of Vennar

which commenced operations in July

2012 and Cosa Ceramics in October

2012.

Depreciation:

The Company

consistently charged depreciation

under the ‘Straight Line Method’

as specified in the Companies Act,

1956. The provision for depreciation

increased 14% from

`

392.58 million

in 2011-12 to

`

446.18 million in

2012-13. This was due to the addition

in gross block during the year under

review. Accumulated depreciation, as

a proportion of the Gross Block, stood

at 32.57% as on March 31, 2013

representing the contemporariness

of the Gross block – an important

competitive edge in a cluttered

industry space.

Investments

The Company’s investment stood at the

level of last year i.e

`

0.81 million as on

March 31, 2013.

Net current assets

Net current assets (working capital)

increased from

`

1,084.91 million

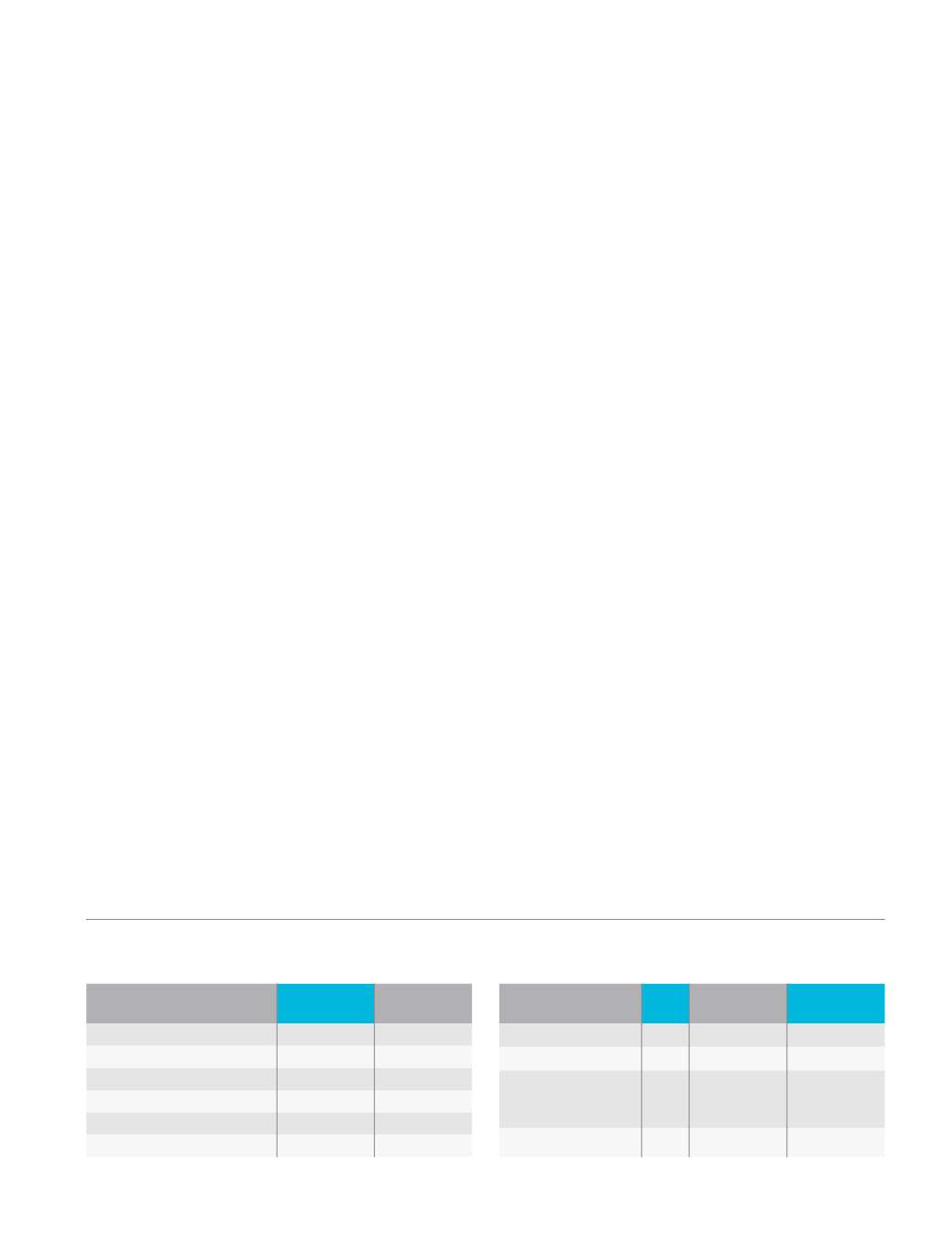

As at March

31, 2013

As at March

31, 2012

Shareholder’s funds

3,608.78

2,820.71

External debt

3,201.66

2,781.92

Deferred tax liabilities

656.27

643.68

Minority interest

275.19

72.20

Capital employed

7,741.90

6,318.51

Average capital employed

7,030.21

6,022.52

Table A: Capital employed in business

(

`

million)

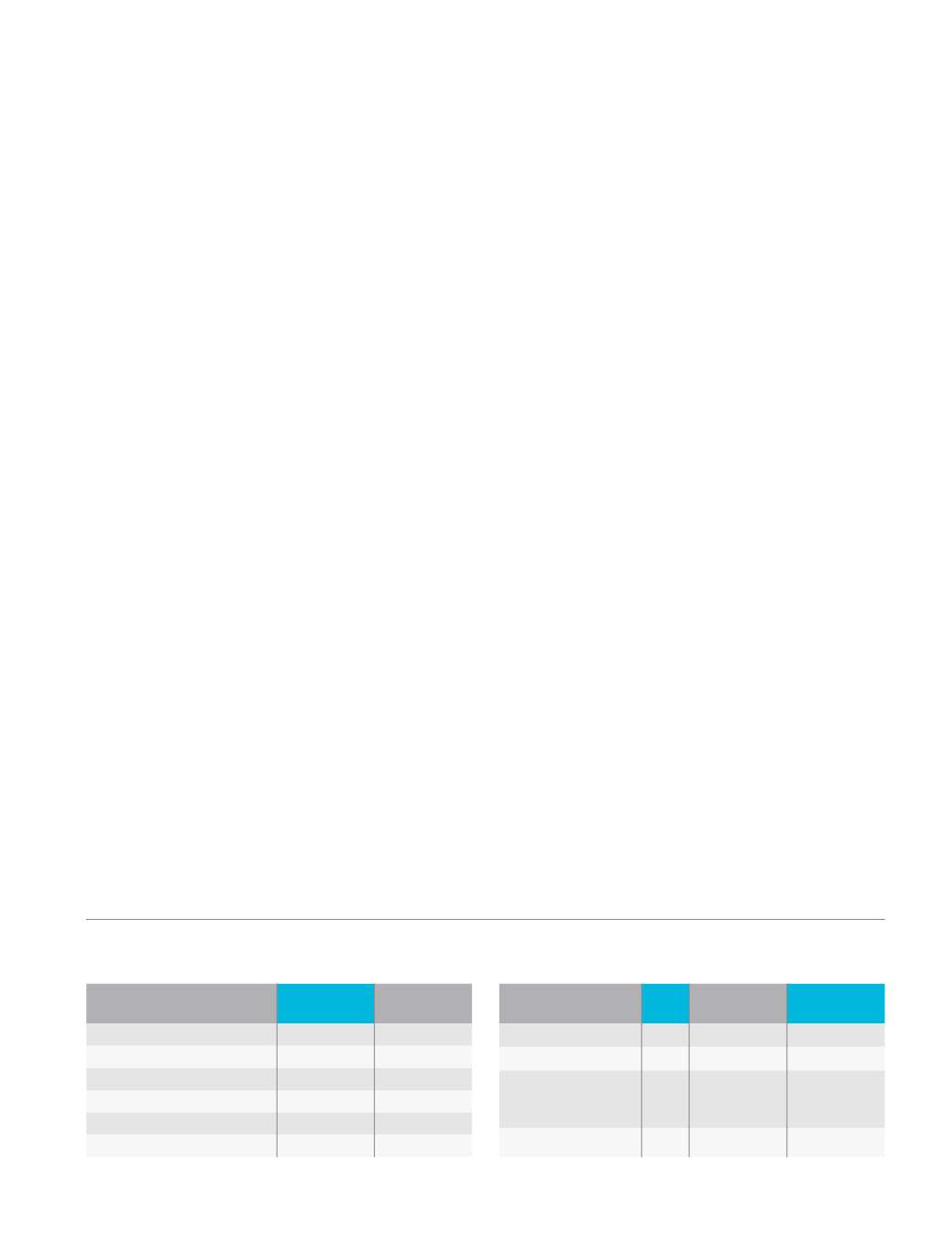

Table B: Reconciliation of external debt

(

`

in million)

Note

As at March

31, 2013

As at March

31, 2012

Long-term borrowings

4

892.69

916.75

Short-term borrowings

7

1,735.06

1,143.28

Current liabilities -

current maturities of

long-term debts

9

573.91

721.89

Total

3,201.66

2,781.92

37