the increase in absolute numbers, the

inventory cycle stood at 46 days in

2012-13 against 48 days in 2011-12.

Sundry Debtors:

Despite a 23%-plus

increase in turnover, the balance in

outstanding receivables increased only

about 21% from

`

1189.48 million as

on March 31, 2012 to

`

1436.28 million

as on March 31, 2013 The debtors’

cycle reduced from 31 days in 2011-12

to 30 days in 2012-13 – highlighting

the demand pull for the product

and brand. More than 97% of the

receivables were outstanding for less

than 180 days – reflecting the strength

in the debtors balance.

Loans and Advances:

The balance

under this head decreased from

`

549.98 million on March 31, 2012 to

`

508.45 million as on March 31, 2013.

As per the new Balance Sheet format,

the balance under Loans and advances

is reflected under the various heads

(refer Table D below).

Long term loans and advances

represent balances recoverable over

a period exceeding 12 months. Other

current assets represent advances

to suppliers and balances with

Government authorities.

Current liability and provisions:

The

balance under this sub-head stood

at

`

2,733.61 million as on March

31, 2013 against

`

2,590.96 million

as on March 31, 2012. The growth

in current liabilities was not in line

with the increased operations due

to a reduction in import creditors. As

per the new balance sheet format,

the balance under current liabilities

and provisions is reflected under the

various heads (refer Table E below).

Internal audit and control

Kajaria has strong, proper and

adequate internal audit and control

systems to ensure that all transactions

are authorised, recorded and reported

correctly. The internal control systems

consist of comprehensive internal

and statutory audits. Internal auditors

independently evaluate adequacy of

internal controls and concurrently audit

the majority of transactions in value

terms. Independence of the audit and

compliance function is ensured by the

direct reporting of the internal audits

to the Audit Committee of the Board.

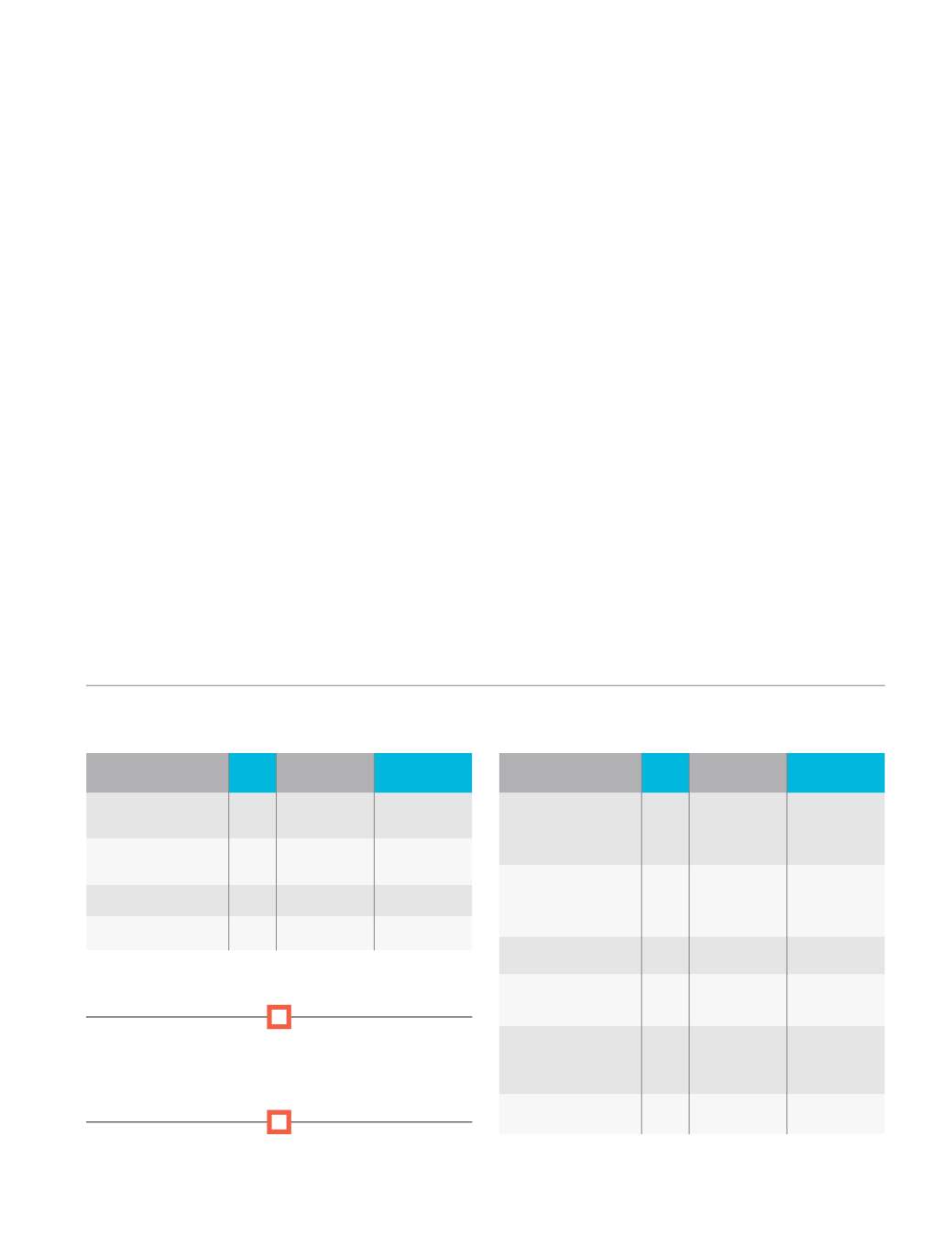

Table D: Reconciliation loans and advances

(

`

in million)

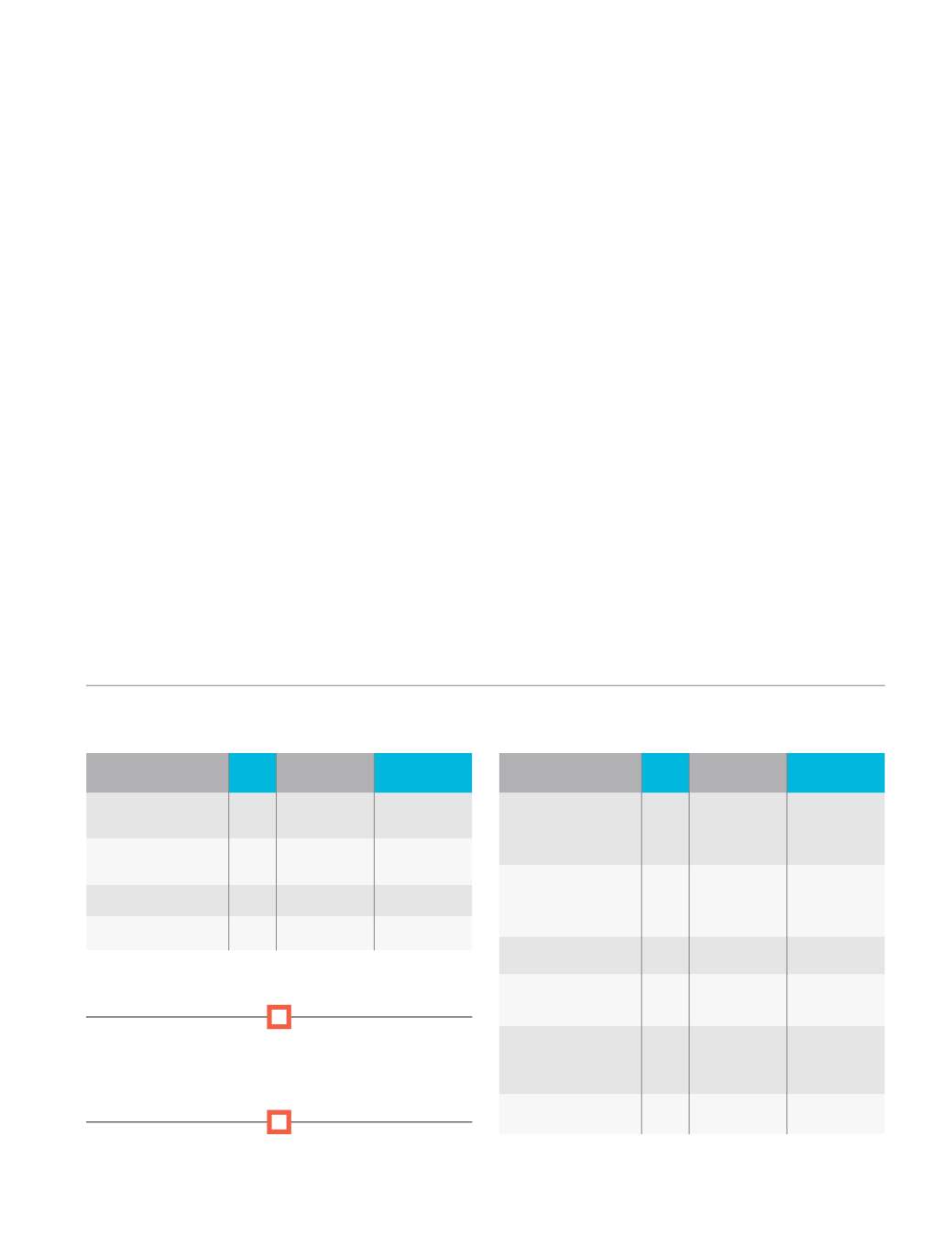

Table E: Reconciliation current liabilities

(

`

in million)

Note

As at March

31, 2013

As at March

31, 2012

Long term loans and

advances

14

174.88

135.85

Short-term loans

and advances

18

328.61

412.48

Other current assets

19

4.96

1.65

Total

508.45

549.98

Note

As at March

31, 2013

As at March

31, 2012

Current liabilities

- As per Balance

Sheet (new format)

7-10 4,955.26 4,393.89

Add: Long-term

provisions (for

gratuity)

6

87.32

62.24

5,042.58 4,456.13

Less: Short term

borrowings

7

1735.06

1143.28

Less: Current

maturities of long

term debts

9

573.91

721.89

Balance

2,733.61 2,590.96

More than 97% of the receivables were outstanding

for less than 180 days – reflecting the strength in the

debtors balance.

39