Balance Sheet

Kajaria’s strength is resident

in its Balance Sheet. The

Company’s prudent policy

of reinvesting operational

surplus in asset building and

de-leveraging its financial

statement has created a

virtuous cycle of growing

liquidity and strengthening

reserves. This has helped

the Company in reporting

industry-beating results – a

low debt-equity ratio with a

healthy return on assets.

Capital employed in the

business increased by 23%

from

`

1125.95 crore as on

March 31, 2015 to

`

1386.35

crore as on March 31, 2016

owing to capacity addition

and an increase in working

capital. The return on capital

employed stood at 31.41%

in 2015-16 against 30.49% in

2014-15.

Shareholders’ funds increased

by 24% from

`

740.94 crore as

on March 31, 2015 to

`

922.32

crore as on March 31, 2016.

This growth was owing to an

increase in the reserves and

surplus balance consequent

to a reinvestment of profits

earned during the year. Equity

capital remained unchanged

at

`

15.89 crore.

The Company’s debt portfolio

increased from

`

243.43 crore

as on March 31, 2015 to

`

296.29 crore as on March 31,

2015. The Company’s debt-

equity ratio stood at 0.30x as

on March 31, 2016, similar to

the previous year.

The Company’s Gross

Block increased by 24%

from

`

1244.67 crore as on

March 31, 2015 to

`

1541.37

crore as on March 31, 2016.

This increase was due to

the addition of tangible

assets consequent to the

Company’s tile manufacturing

capacity addition and

commissioning of its faucets

facility. The balance under

capital work-in-progress

declined to

`

7.83 crore as

on March 31, 2016 against

`

77.76 crore as on March

31, 2015 consequent to the

commissioning of planned

projects.

The working capital cycle

increased from 28 days as

on 31st March 2015 to 46

days as on 31st March 2016

primarily due to increase in

inventories and receivables

due to challenging market

conditions, increased cash

and bank balance and

reduction in import creditors.

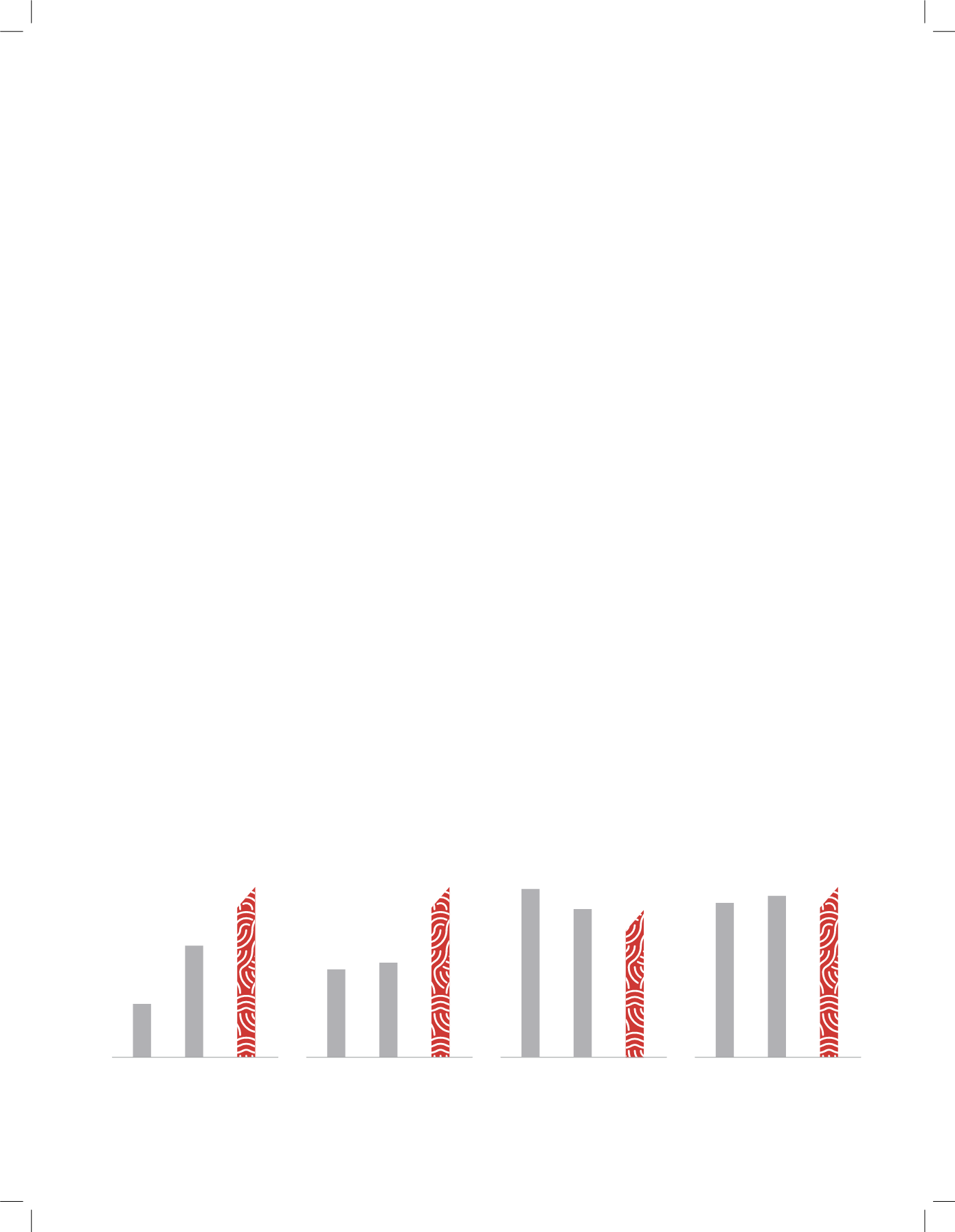

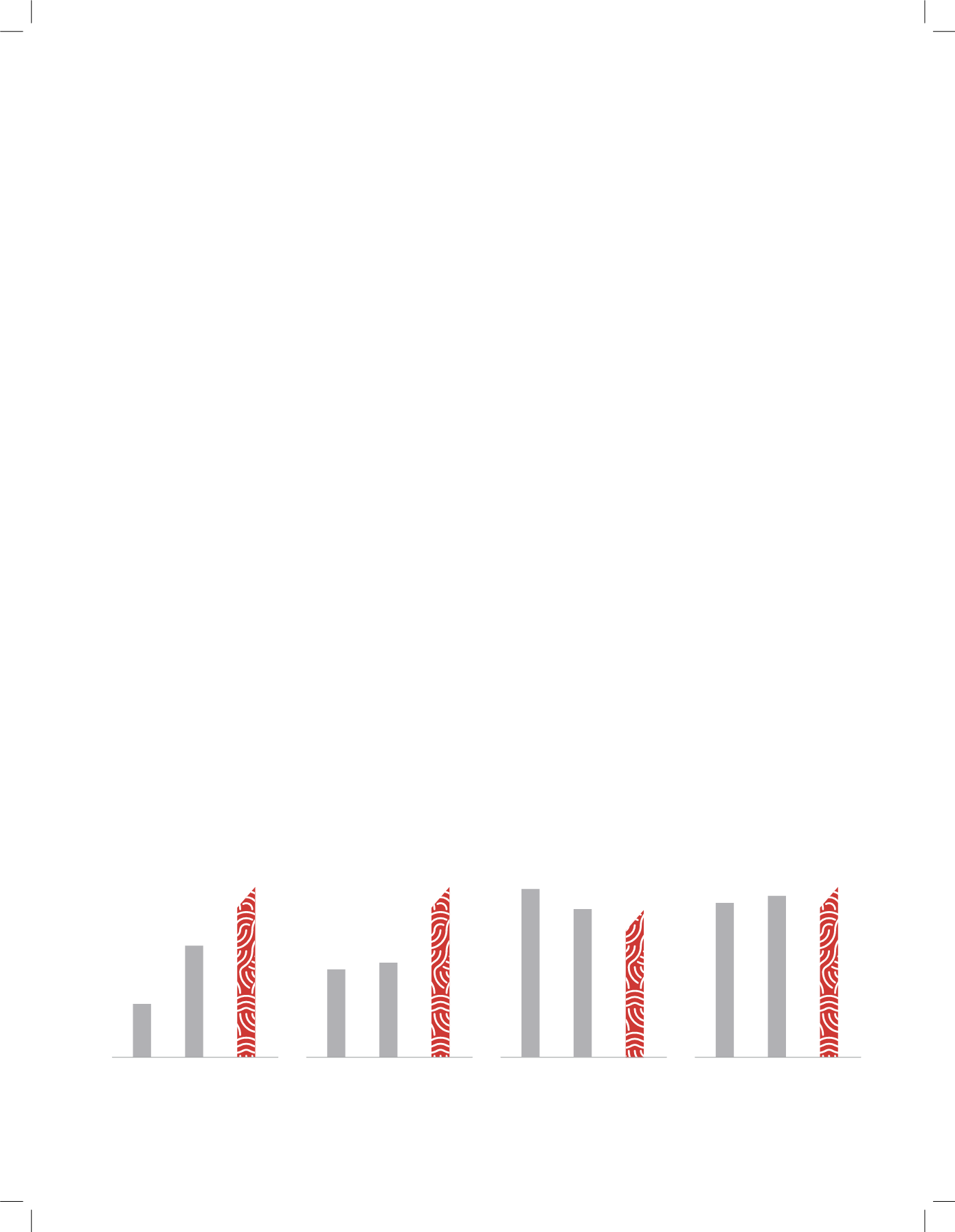

Debt-equity (x)

13-14

0.41

14-15

0.30

15-16

0.30

Addition to Gross Block

(

`

crore)

13-14

95.06

14-15

221.12

15-16

289.43

ROCE (%)

13-14

29.06

14-15

30.49

15-16

31.41

Working capital cycle

(days)*

13-14

25

14-15

28

15-16

46

*excluding project creditors

ANNUAL REPORT 2015-16

l

43