96

Kajaria Ceramics Limited

Annual Report

2012-13

25

YEARSOF

WORKINGWITH

ANATTITUDE

CELEBRATING

Notes on Accounts

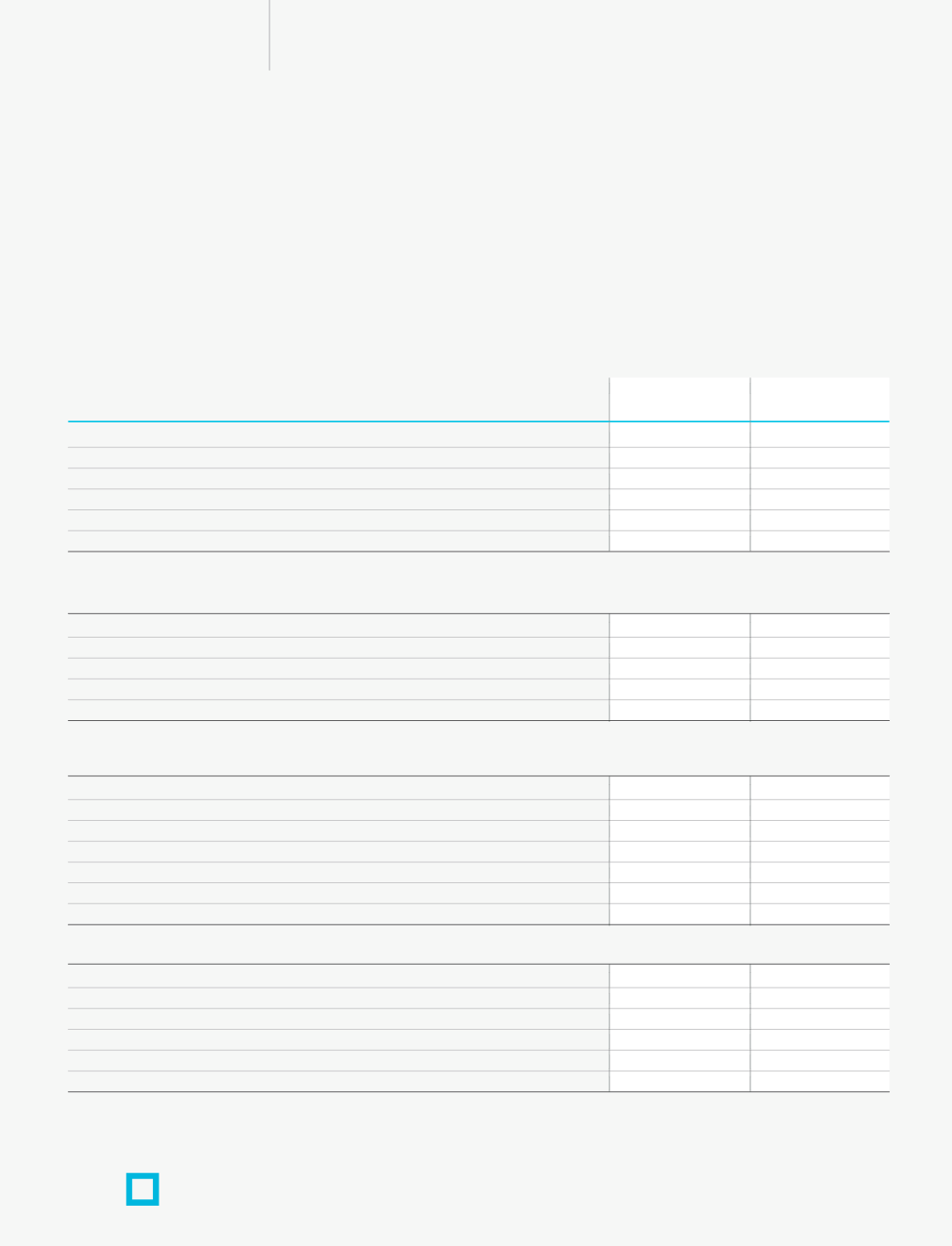

34. Gratuity And Other Post-Employment Benefit Plans:

The Company has a defined benefit gratuity plan. Gratuity (being administered by a Trust) is computed as 15 days salary, for every

completed year of service or part thereof in excess of 6 months and is payable on retirement / termination / resignation. The benefit

vests on the employee completing 5 years of service. The Gratuity plan for the Company is a defined benefit scheme where annual

contributions are deposited to a Gratuity Trust Fund established to provide gratuity benefits. The Trust Fund has taken a Scheme of

Insurance, whereby these contributions are transferred to the insurer. The Company makes provision of such gratuity asset/liability in

the books of accounts on the basis of actuarial valuation as per the Projected unit credit method. Plan assets also include investments

and bank balances used to deposit premiums until due to the insurance company.

The following tables summarize the components of net benefit expense recognised in the profit and loss account and the funded

status and amounts recognised in the balance sheet for the plan:

31.03.2013

31.03.2012

Particulars

`

in million

`

in million

Current Service cost

13.83

11.21

Interest cost on benefit obligation

7.13

5.93

Net actuarial loss recognised in the year

6.61

5.56

Past service cost

–

–

Expected Return on Plan Assets

(1.99)

(1.12)

Net benefit expense

25.08

21.58

Statement of Profit and Loss account

Net employee benefit expense (recognised in Employee cost)

Fair Value of Plan Assets at the end of the period

23.86

24.35

Liability at the end of the period

111.17

86.59

Difference

87.32

62.24

Less: Unrecognised past service cost

–

–

Amount recognized in the Balance Sheet

87.32

62.24

Balance Sheet

Details of provision for Gratuity

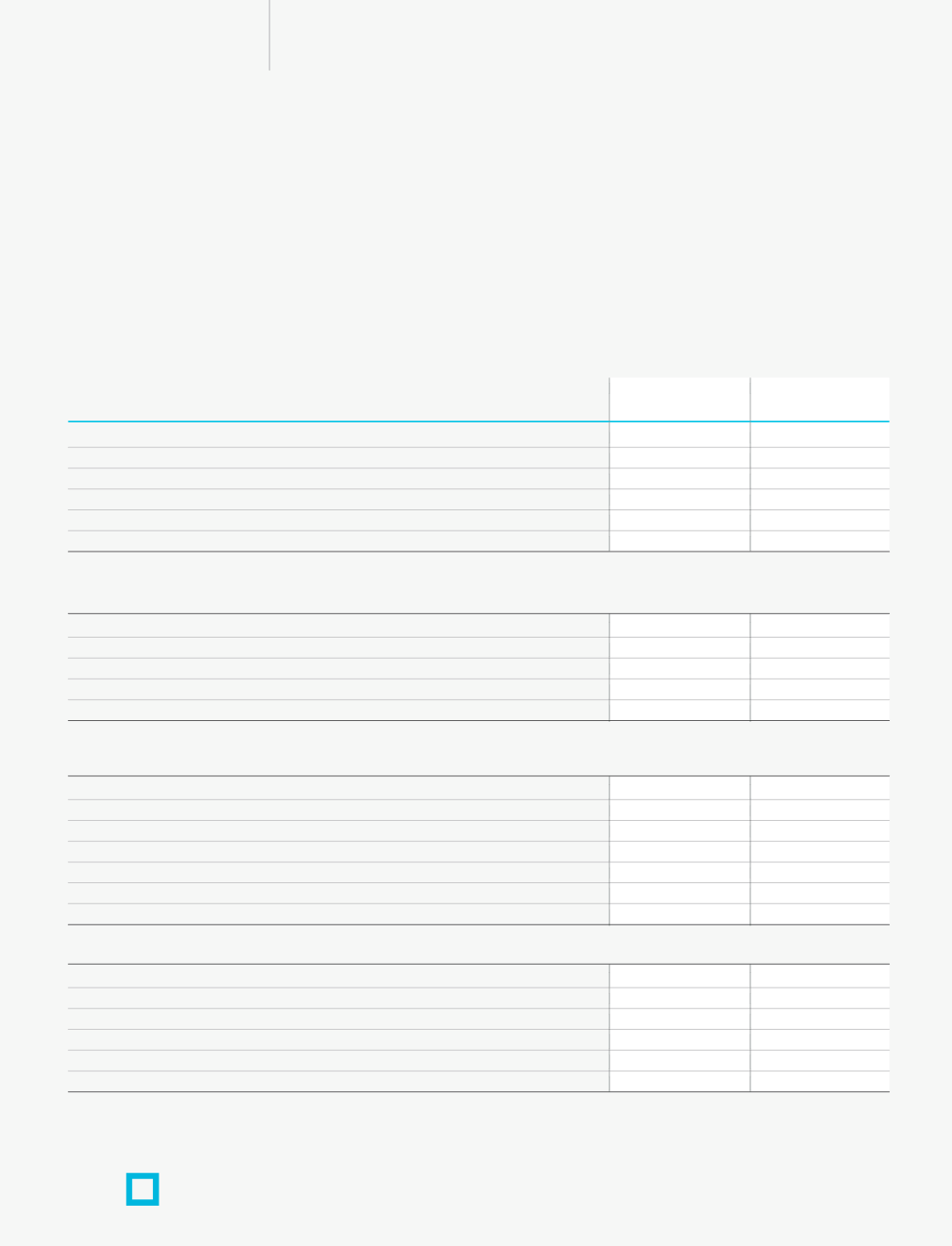

Defined benefit obligation as at 1st April, 2012

86.59

67.77

Interest Cost

7.13

5.93

Current service cost

13.83

11.21

Benefit paid

(2.99)

(3.87)

Past Service Cost – Vested Benefit

–

–

Actuarial losses on obligation

6.61

5.56

Defined benefit obligation as at 31st March, 2013

111.17

86.60

Changes in the present value of the defined benefit obligation are as follows:

Fair value of plan assets as at 1st April, 2012

24.35

25.60

Return on Plan Assets

2.50

1.12

Contributions by employer

–

1.50

Benefits paid

(2.99)

(3.87)

Actuarial Gains / (losses)

–

–

Fair value of plan assets as at 31st March, 2013

23.86

24.35

Changes in the fair Value of plan assets are as follows: