89

Notes on Accounts

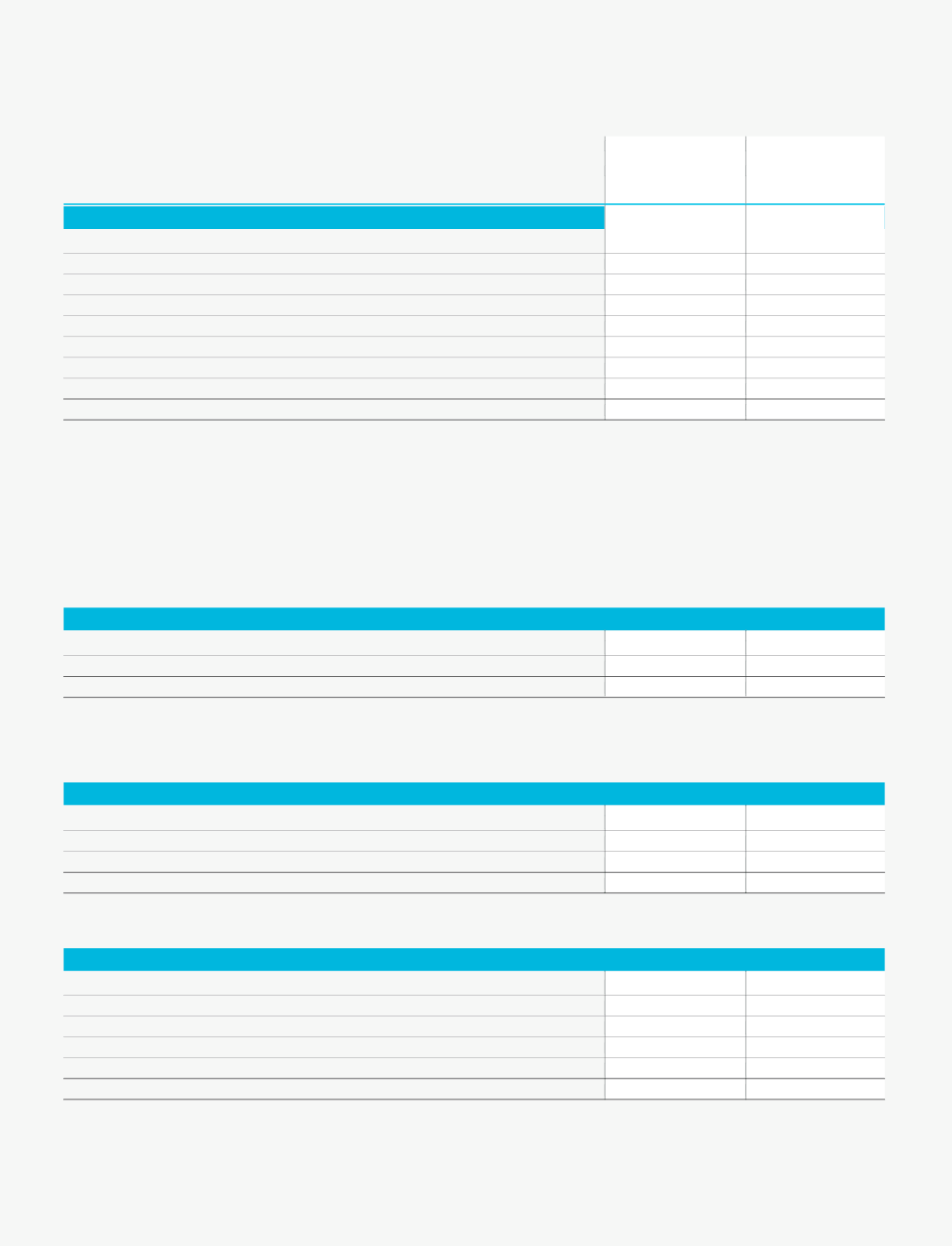

4. LONG-TERM BORROWINGS

As at

As at

31.03.2013

31.03.2012

`

in million

`

in million

NOTES :

1. Term loans from Banks are secured by 1st charge on immovable and movable assets (present and future) of the Company (subject to

prior charges on movables in favour of banks) ranking pari-pasu with the charges created in favour of participating Banks and further

guaranteed by the Directors of the Company.

2. Term Loans from others parties are secured against respective assets financed.

3. The term loans are repayable generally over a period of three to five years after a moratarium period of one to two years in installments

as per the terms of the respective agreements.

A. TERM LOANS

From Banks

- Secured

775.25

898.41

From Other Parties

- Secured

19.71

18.34

B. PROMOTER LOANS

- From Directors, shareholders & relatives

Unsecured

97.73

0.00

892.69

916.75

As At 1st April 2012

643.68

603.20

Add : Additional adjustment for current year

12.59

40.48

As at 31st March 2013

656.27

643.68

The net increase during the year in the deferred tax liability

`

12.59 Million (previous year increase

`

40.48 million) has been debited to

the Statement of Profit & Loss.

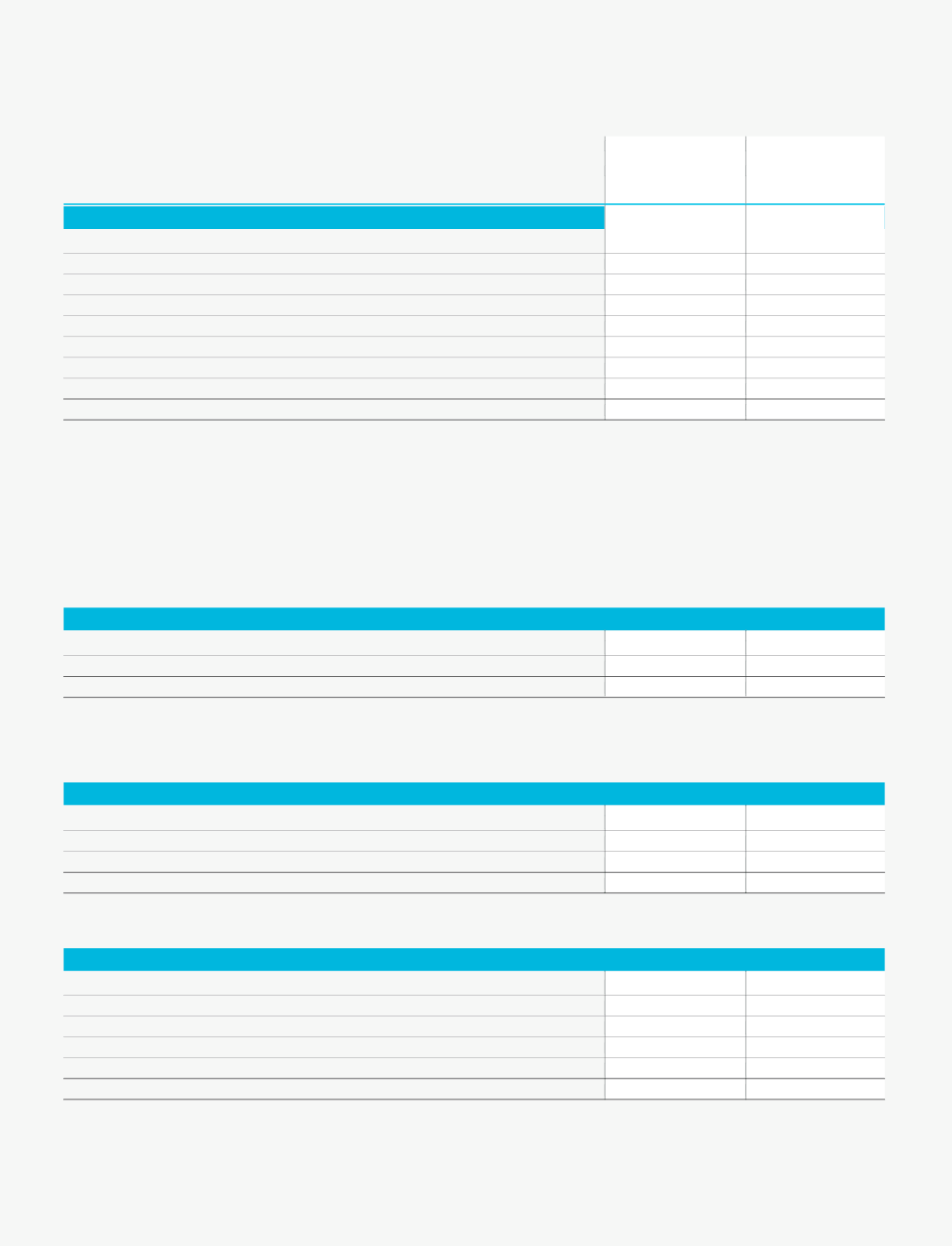

5. DEFERRED TAX LIABILITY

Provision for Gratuity Obligation

As per last balance sheet

62.24

42.16

Additions during the year

25.08

20.08

Total

87.32

62.24

Refer Note No. 35 for detailed disclosure as per AS 15.

6. LONG TERM PROVISIONS

Loans Repayable On Demand

Working Capital Facilities

- From Banks (Secured)

1,535.06

1,106.24

Short Term Loans & Advances

- From Banks (Unsecured)

200.00

37.04

Total

1,735.06

1,143.28

Working Capital Facilities from Banks are secured by 1st charge on inventories and book debts and second charge on immovable and

movable assets of the Company ranking pari passu amongst the Banks and further guaranteed by the Directors of the Company.

7. SHORT-TERM BORROWINGS