95

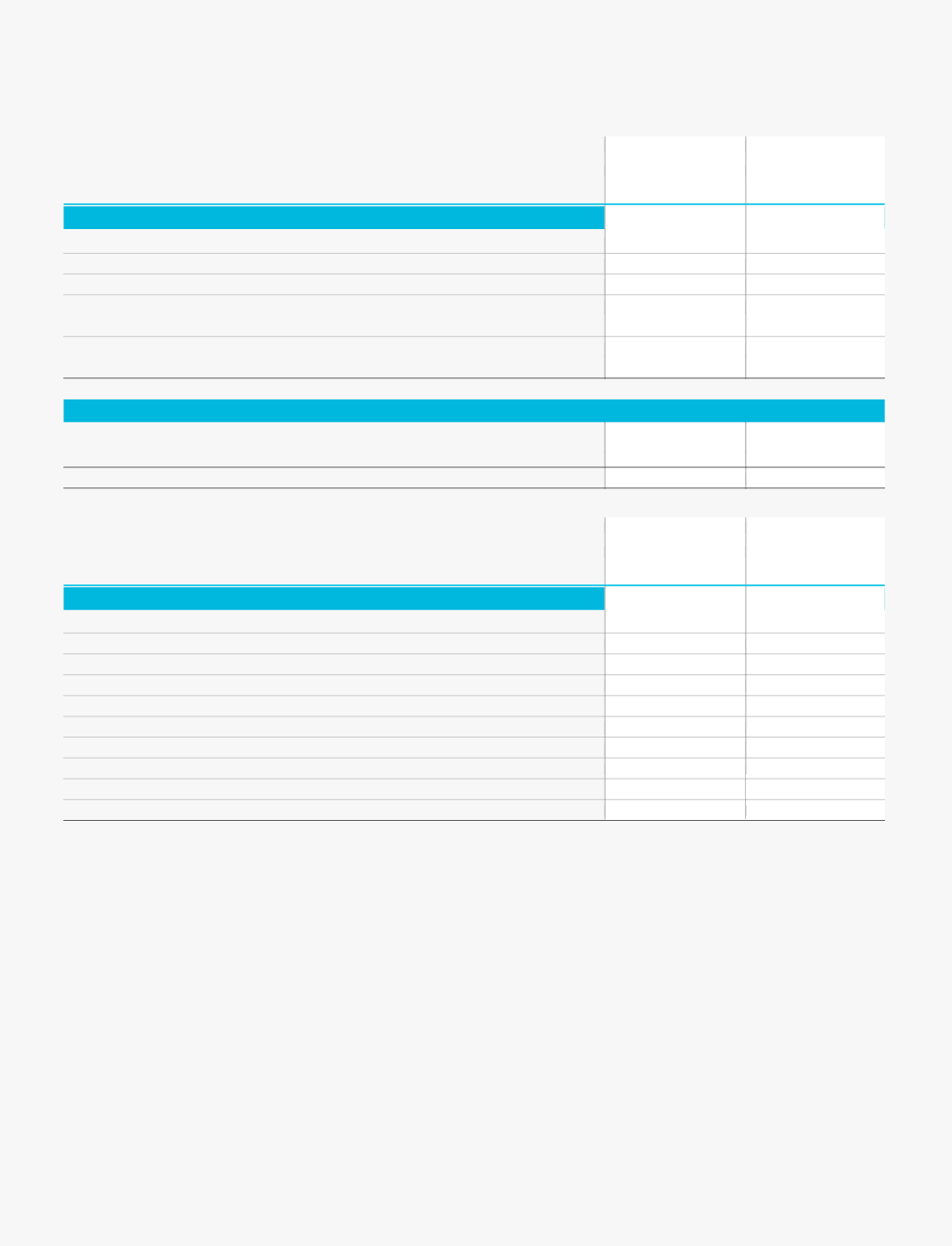

27. CONTINGENT LIABILITIES

As at

As at

31.03.2013

31.03.2012

`

in million

`

in million

(excluding matters separately dealt with in other notes):

a. In respect of Bills discounted With the Company’s Bankers

73.72

21.13

b. Counter guarantees issued in respect of guarantees issued by company’s bankers

Nil

0.50

c. In respect of Excise Duty, Sales Tax, Service Tax, Custom Duty Demands pending

63.94

71.28

before various authorities and in dispute

d. In respect of disputed Electricity Demand pending with appellate

25.41

16.67

authorities and other consumer cases.

a. Estimated amount of contracts remaining to be executed on Capital Account and

not provided for (Net of advances)

54.62

10.18

b. Letters of Credit opened in favour of inland/overseas suppliers (Net)

732.84

1303.13

28. COMMITMENTS

Notes on Accounts

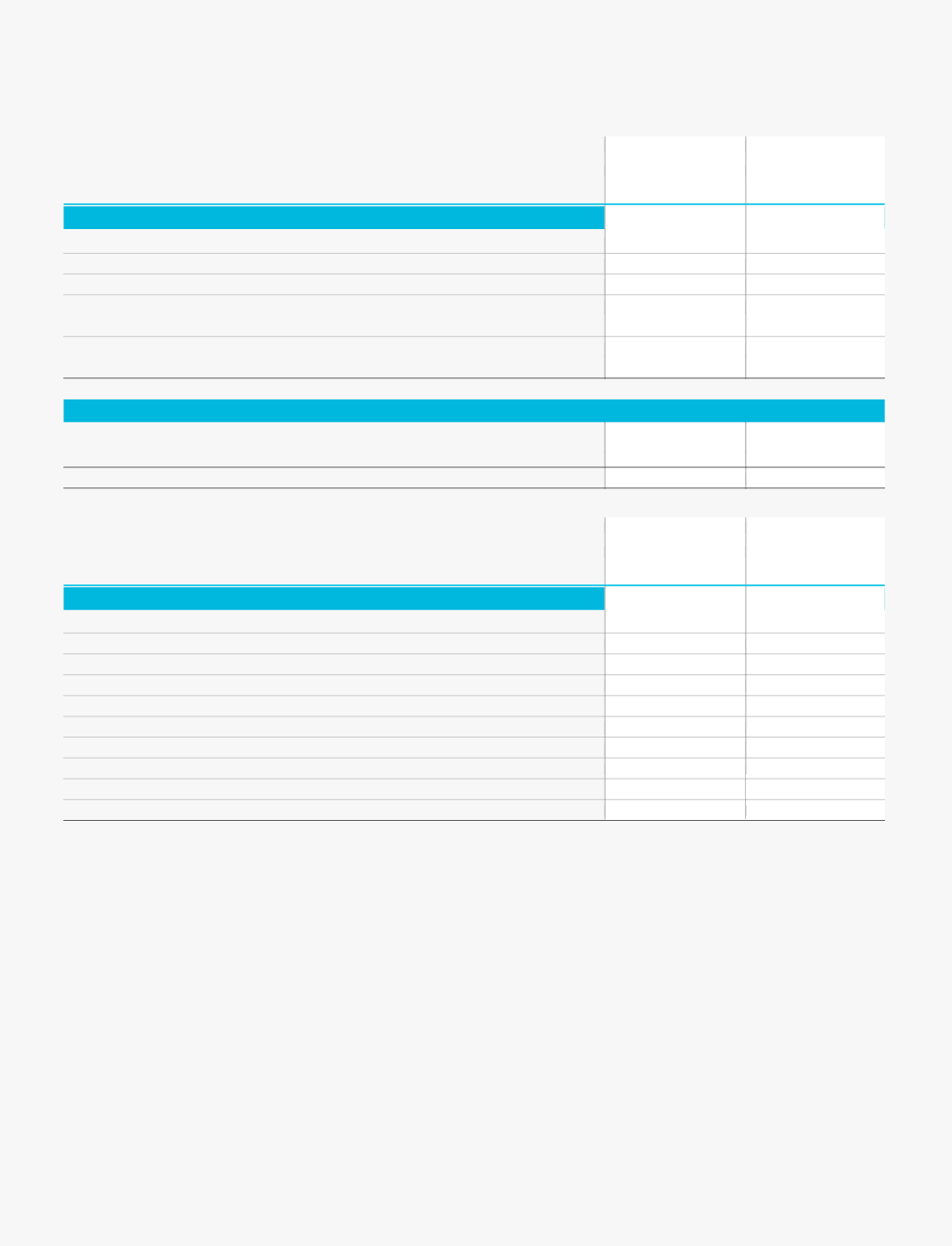

29. PARTICULARS OF SALES & STOCKS

Year ended

Year ended

31.03.2013

31.03.2012

`

in million

`

in million

a) Opening Stock

Tiles

1201.99

1007.64

b) Purchases

Tiles

3973.45

3620.53

c) Sales

Tiles (Manufactured)

13206.77

8850.42

Tiles (Trading)

4111.68

5206.83

Power

17.35

14.87

d) Closing Stock

Tiles

1445.18

1202.00

30.

As per policy of the Company for Directors and other senior employees the Company has, during the year, paid a sum of

`

50 lacs on

account of insurance premium under the employer employee policy obtained on the life of key directors and the same lies debited

under the head ‘Insurance Charges’. The policy may be assigned in the name of the insured in future. In such an event of assignment

of the policy, the same shall be treated as perquisite in the hands of the key personnel.

31.

Balances of certain debtors, creditors, loans and advances are subject to confirmation.

32.

In the opinion of the Management current assets, loans and advances have a value on realisation in the ordinary course of business

at least equal to the amount at which they are stated except where indicated otherwise.

33.

The Company was hitherto amortizing goodwill arising on consolidation on straight line basis over a period of five years. However,

since the Accounting Standard (AS) 21-“Consolidated Financial Statements” issued by the Institute of Chartered Accountants of India

does not stipulate for such amortization, the Company has changed the accounting policy and is now testing the goodwill annually

for impairment. Goodwill amortized till 31st March, 2012 has been reversed. As a result of this change, amortization charge for current

year is lower by

`

19.77 million. Had there been no change, pre tax profit for the year would have been lower by

`

19.77 million and

intangible assets would have been higher by

`

19.77 million.