Notes on the financial statements

37.

EMPLOYEE SHARE-BASED PAYMENT

Description of share based payments arrangements

During the year, the Company granted stock options to certain employees of the Company and its subsidiaries. The Company has the

following share-based payment arrangements for employees.

Kajaria Ceramics Employee Stock Option Plan 2015 (ESOP 2015)

The ESOP 2015 (“the Plan”) was approved by the Board of Directors and the shareholders on 7th September 2015. The plan entitles

employees of the Company and its subsidiaries to purchase shares in the Company at the stipulated exercise price, subject to compliance

with vesting conditions. Stock options will be settled by issue of equity shares. As per the Plan, holders of vested options are entitled

to purchase one equity share for every option at an exercise price of

`

850, which is 7.42 % below the stock price i.e.

`

918.10 at the

date of grant, i.e., 20th October, 2015.

Reconciliation of outstanding share options

The number of options granted during the year remains same as at the end of the year. There were no options exercisable during the year.

As permitted by the Guidance Note on accounting for Employee Share - based Payment, issued by the Institute of Chartered Accountants

of India, the Company has elected to account for stock options based on their intrinsic value (i.e., the excess of fair market value of the

underlying share over the exercise price) at the grant date rather than fair value at that date. Had the compensation cost for employee

stock options been determined on the basis of the fair value method as described in the said Guidance Note, the Company’s net profit

after tax would have been lower by 0.44 crores (previous year NIL), and basic earnings per share would have been 29.50 (previous year

21.80) and diluted earnings per share would have been 29.46 (previous year 21.80).

For purposes of the above proforma disclosures, the fair values are measured based on the Black-Scholes-Merton formula. Expected

volatility, an input in this formula, is estimated by considering historic average share price volatility. The inputs used in the measurement

of grant-date fair values are as follows:

(

`

in crores)

For the year ended

31 March 2016

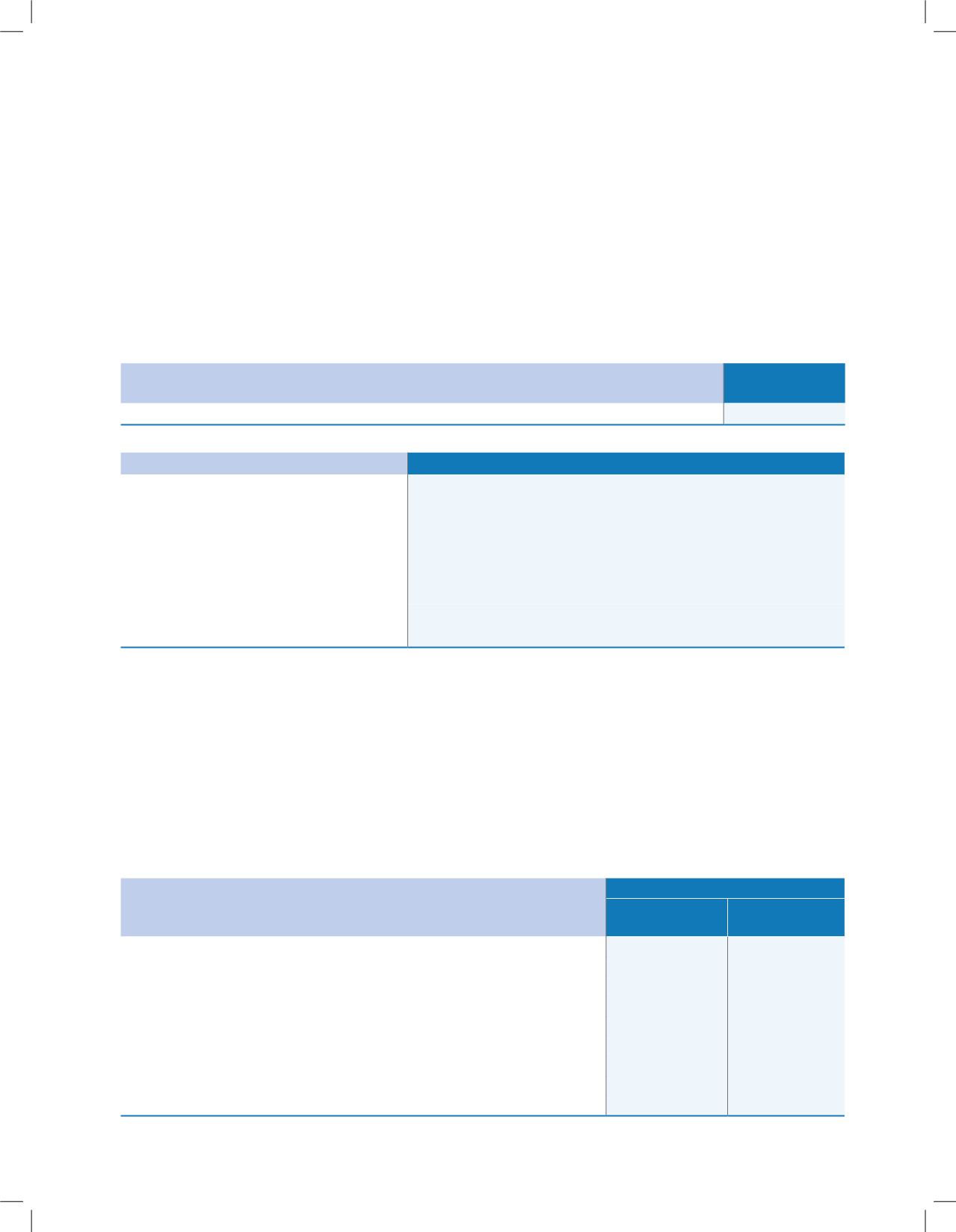

Expense recognised in employee benefits

0.17

Share based payment expense

Name of Scheme

Employee Stock Option Plan 2015

Vesting conditions

22,900 options 24 months after the grant date (‘First vesting’)

45,800 options 36 months after the grant date (‘Second vesting’)

68,700 options 48 months after the grant date (‘Third vesting’)

91,600 options 60 months after the grant date (‘Fourth vesting’)

Exercise period

Stock options can be exercised within a period of 8 years from grant date.

Number of share options

2,29,000

Exercise Price

`

850/-

Remaining Life as on 31.03.2016

4.50 years

Particulars of Scheme

(

`

in crores)

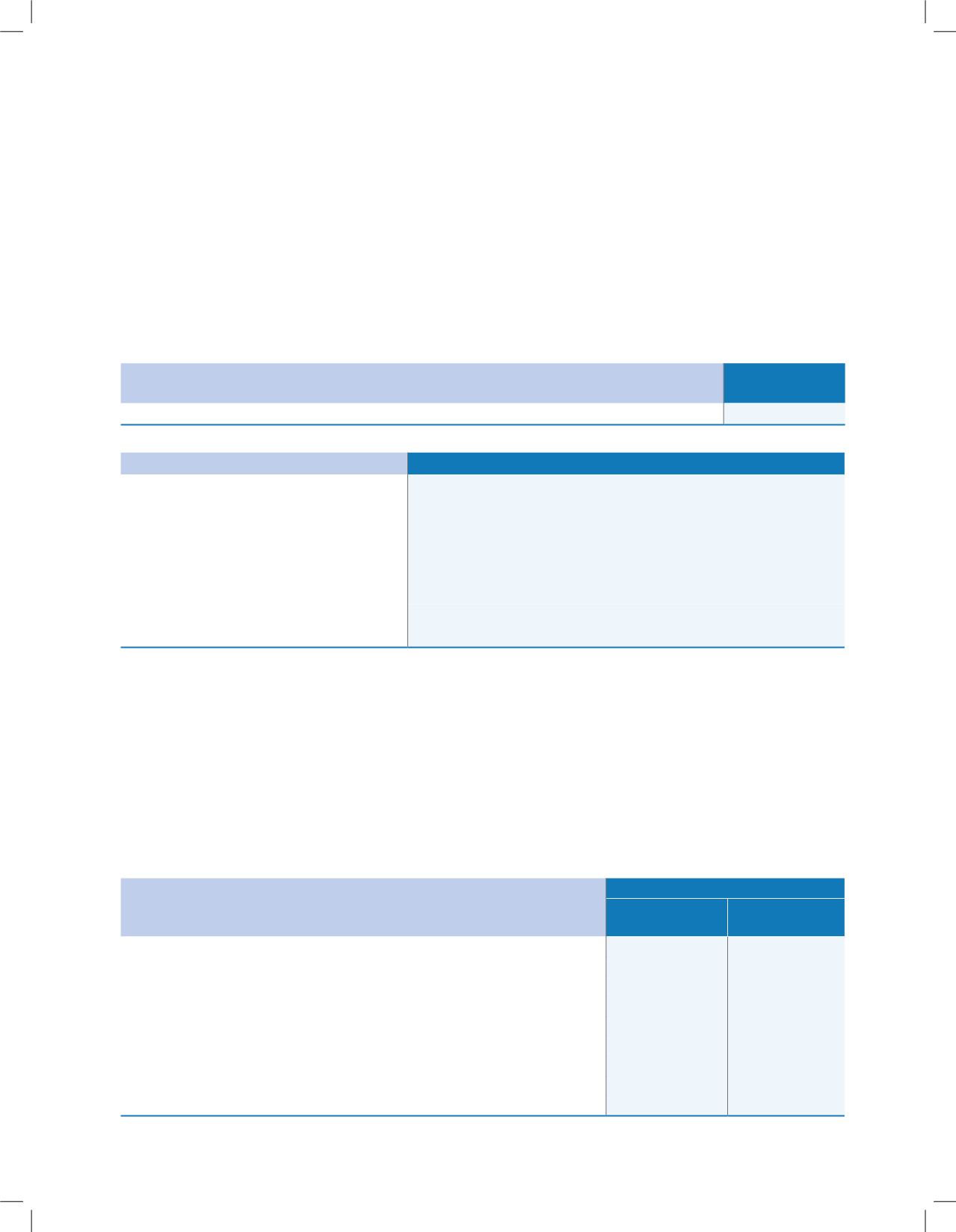

Particulars

31 March 2016

Options vested Options to be

vested

Number of options

-

229,000

Fair value on grant date

-

850

Share price at grant date

-

918.10

Exercise price

-

850.00

Expected volatility

-

27.63%

Expected life

-

4.5 years

Expected dividends

-

0.40%

Expected Attrition rate

-

3.00%

Risk-free interest rate (based on government bonds)

-

7.30%

126

Kajaria Ceramics Limited