Notes on the financial statements

Particulars

31 March 2016

31 March 2015

Discount rate

8.00%

8.00%

Expected rate of return on plan assets

8.00%

7.75%

Salary Escalation

8.00%

7.75%

Attrition Rate

1%

1%

Retirement Age

60 Years

60 Years

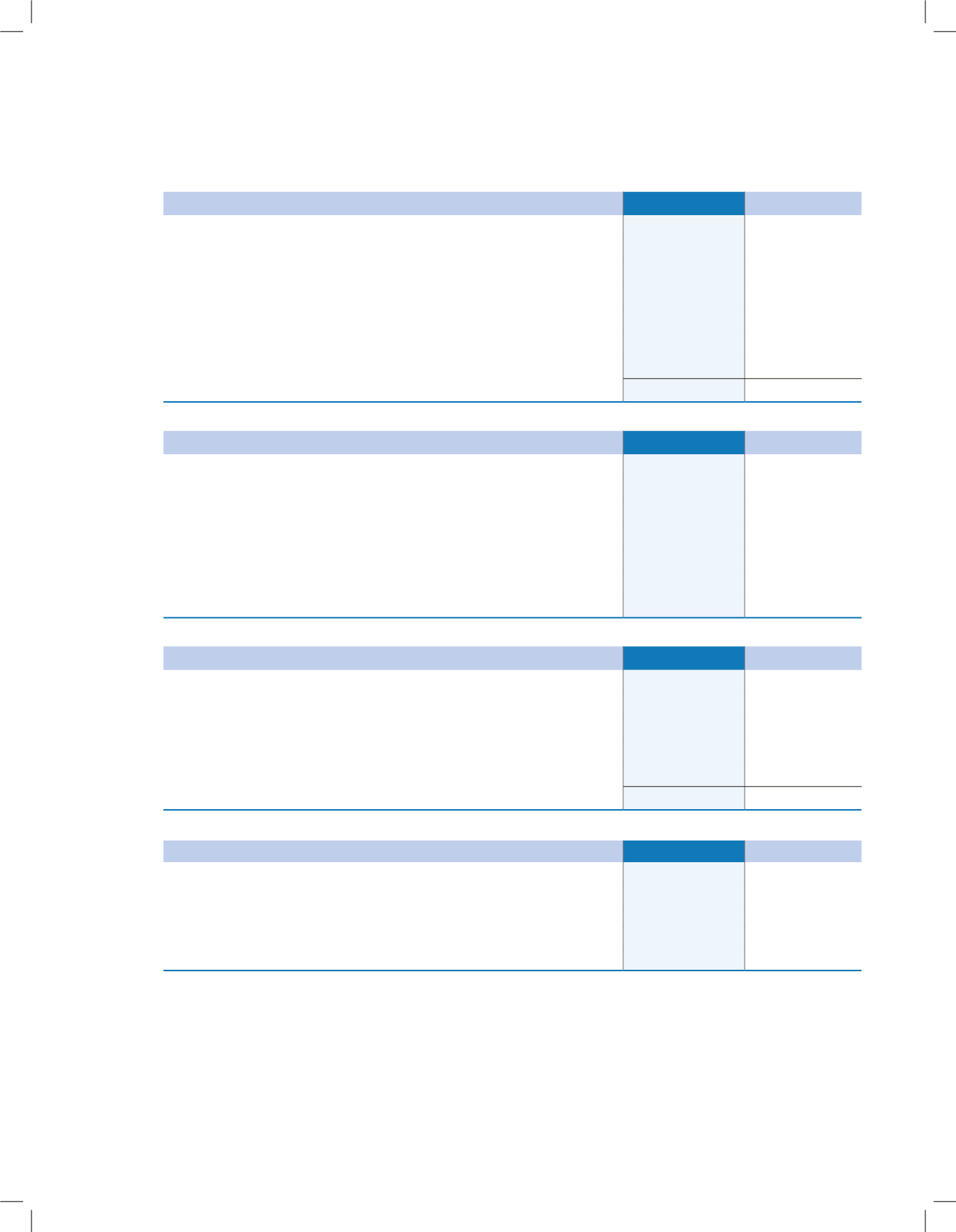

The principal assumption used in determining gratuity benefit obligations for the Company’s plans are shown below:

(

`

in crores)

Particulars

31 March 2016

31 March 2015

Defined benefit obligation as at 1st April 2015

17.07

13.57

Interest Cost

1.36

1.09

Current service cost

2.07

1.85

Benefit paid

(0.78)

(0.45)

Past Service Cost – Vested Benefit

0.00

0.00

Actuarial losses on obligation

0.59

1.02

Defined benefit obligation as at 31st March 2016

20.31

17.07

Changes in the present value of the defined benefit obligation are as follows:

(

`

in crores)

Particulars

31 March 2016

31 March 2015

Fair value of plan assets as at April 1 2015

6.98

4.82

Return on Plan Assets

0.69

0.46

Contributions by employer

3.86

2.53

Benefits paid

(0.78)

(0.45)

Actuarial Gains / (losses)

(0.42)

(0.37)

Fair value of plan assets as at March 31, 2016

10.33

6.98

Changes in the fair Value of plan assets are as follows:

(

`

in crores)

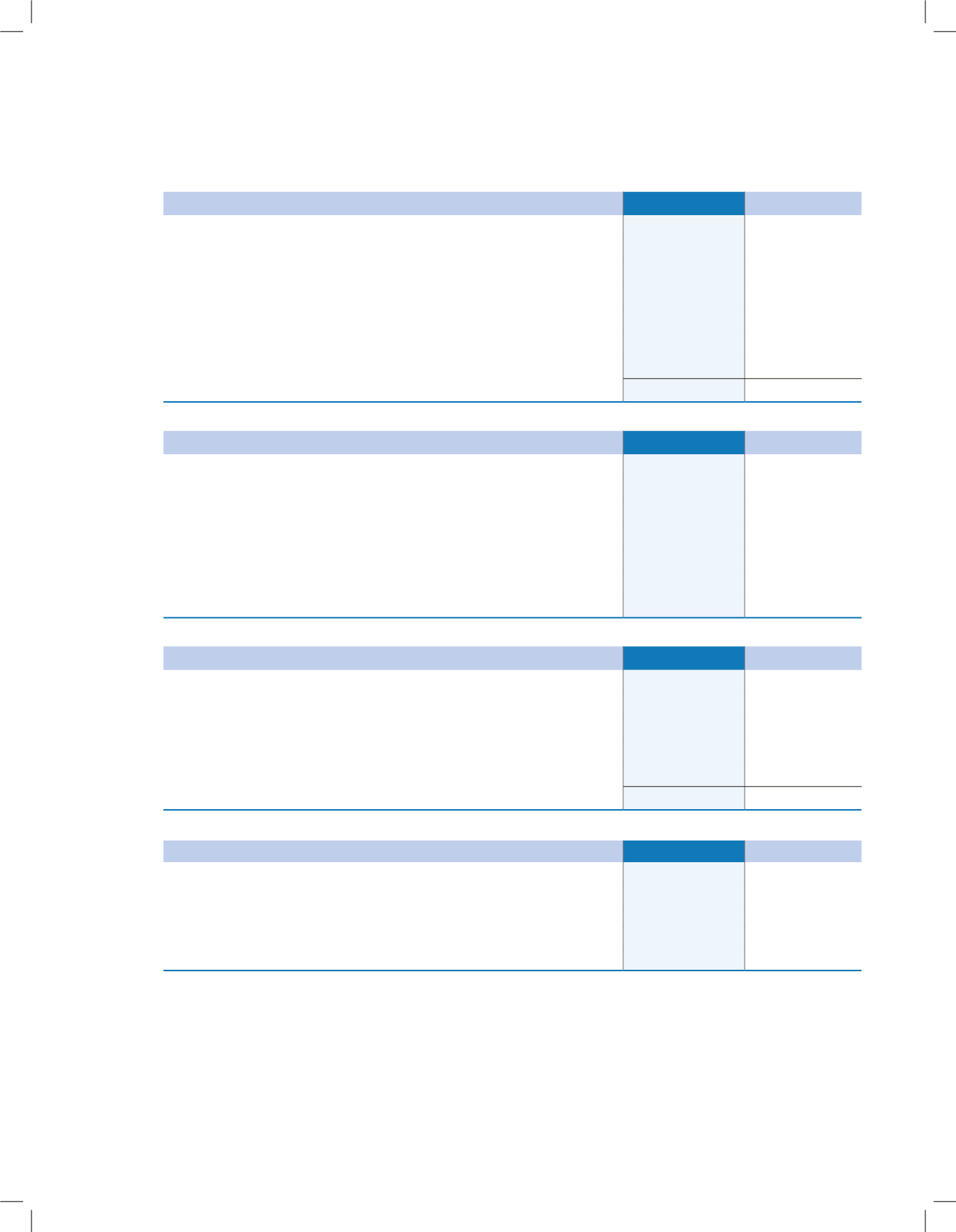

Particulars

31 March 2016

31 March 2015

Fair Value of Plan Assets at the end of the year

10.33

6.99

Liability at the end of the year

20.31

17.07

Difference

9.98

10.08

Less: Unrecognised past service cost

NIL

NIL

Amount recognized in the Balance Sheet

Non – Current portion

9.31

9.73

Current portion

0.67

0.36

Total

9.98

10.09

Balance Sheet

Details of provision for Gratuity

The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority, promotion and other

relevant factors, such as supply and demand in the employment market.

34. SEGMENTAL REPORTING:

The business activity of the company falls within one broad business segment viz. “Ceramic/ Vitrified Tiles” and substantially sale of

the product is within the country. The Gross income and profit from the other segment is below the norms prescribed in AS-17 of The

Institute of Chartered Accountants of India. Hence the disclosure requirement of Accounting Standard 17 of “Segment Reporting”

issued by the Institute of Chartered Accountants of India is not considered applicable.

121

Annual Report 2015-16