67

Notes on Accounts

X.

Research & Development:

Revenue expenditure on research and development is charged to Profit & Loss Account in the year in which it is incurred. Capital

expenditure on research and development is treated as additions to Fixed Assets in case the same qualifies as a tangible asset as

per AS – 10 issued by ICAI.

XI. Provision, Contingent Liabilities and Contingent Assets:

Provisions involving substantial degree of estimation in measurement are recognized when there is a present obligation as a result

of past events and it is probable that there will be an outflow of resources. Contingent liabilities are not recognized but are disclosed

in the notes. Contingent assets are neither recognized nor disclosed in the financial statements.

XII. Government grants and subsidies:

Grants and subsidies from the government are recognized when there is reasonable assurance that (i) the Company will comply with

the conditions attached to them, and (ii) the grant/ subsidy will be received.

Where the grant or subsidy relates to revenue, it is recognized as income on a accrual basis in the Statement of Profit and Loss.

Where the grant relates to a fixed asset, it is net off from the relevant asset.

XIII.

Dividend received is accounted for as and when it is declared.

XIV.

Unless specifically stated to be otherwise, these policies are consistently followed.

1. SIGNIFICANT ACCOUNTING POLICIES

a) The Company has not issued any shares during the year.

b) The holders of the equity shares are entitled to receive dividends as declared from time to time, and are entitled to voting rights

proportionate to their share holding at the meetings of shareholders.

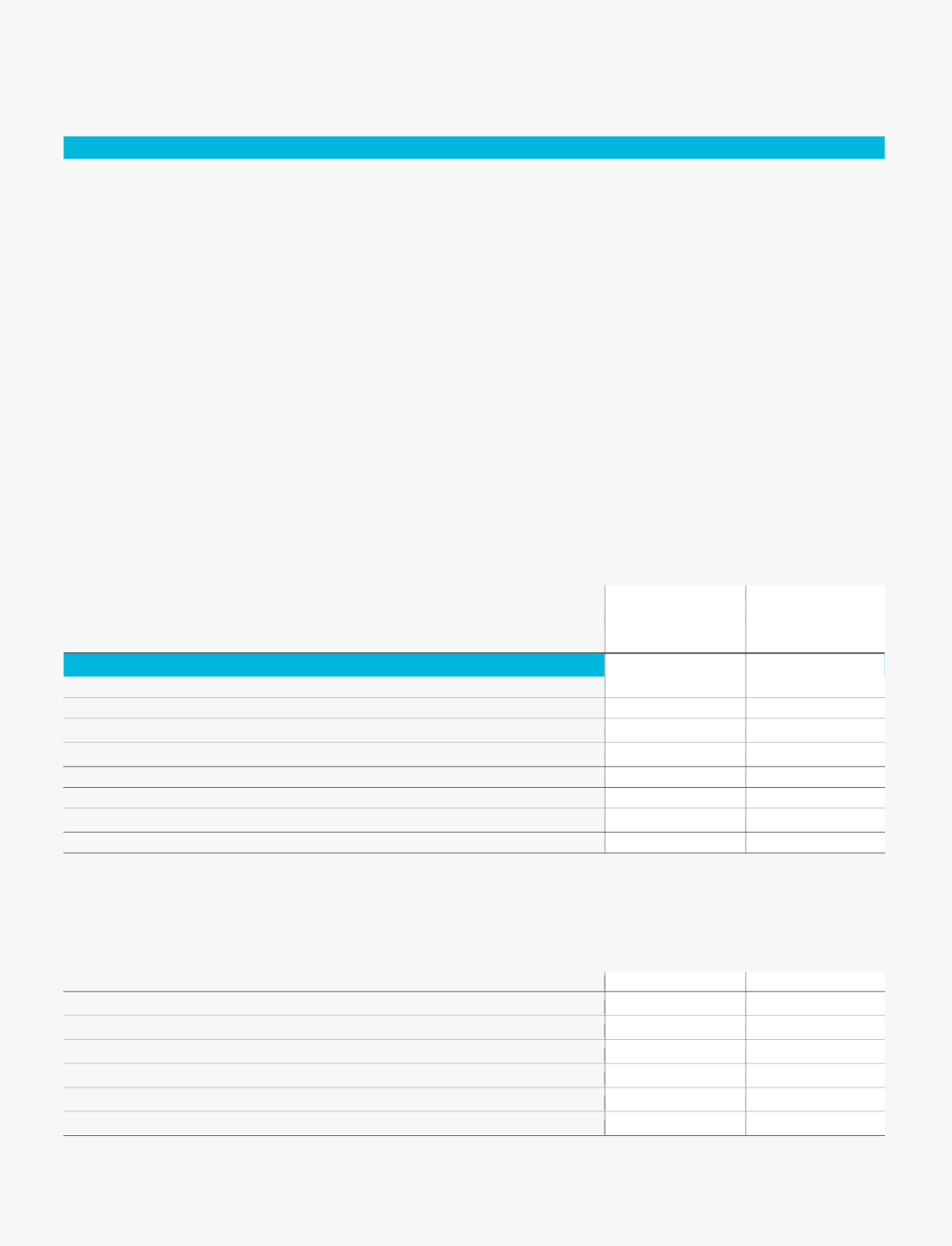

c) Following Shareholders hold equity shares more than 5% of the total equity shares of the company at the end of the period :-

D) The company has not issued shares for a consideration other than cash or bonus shares during the immediately preceding 5 years.

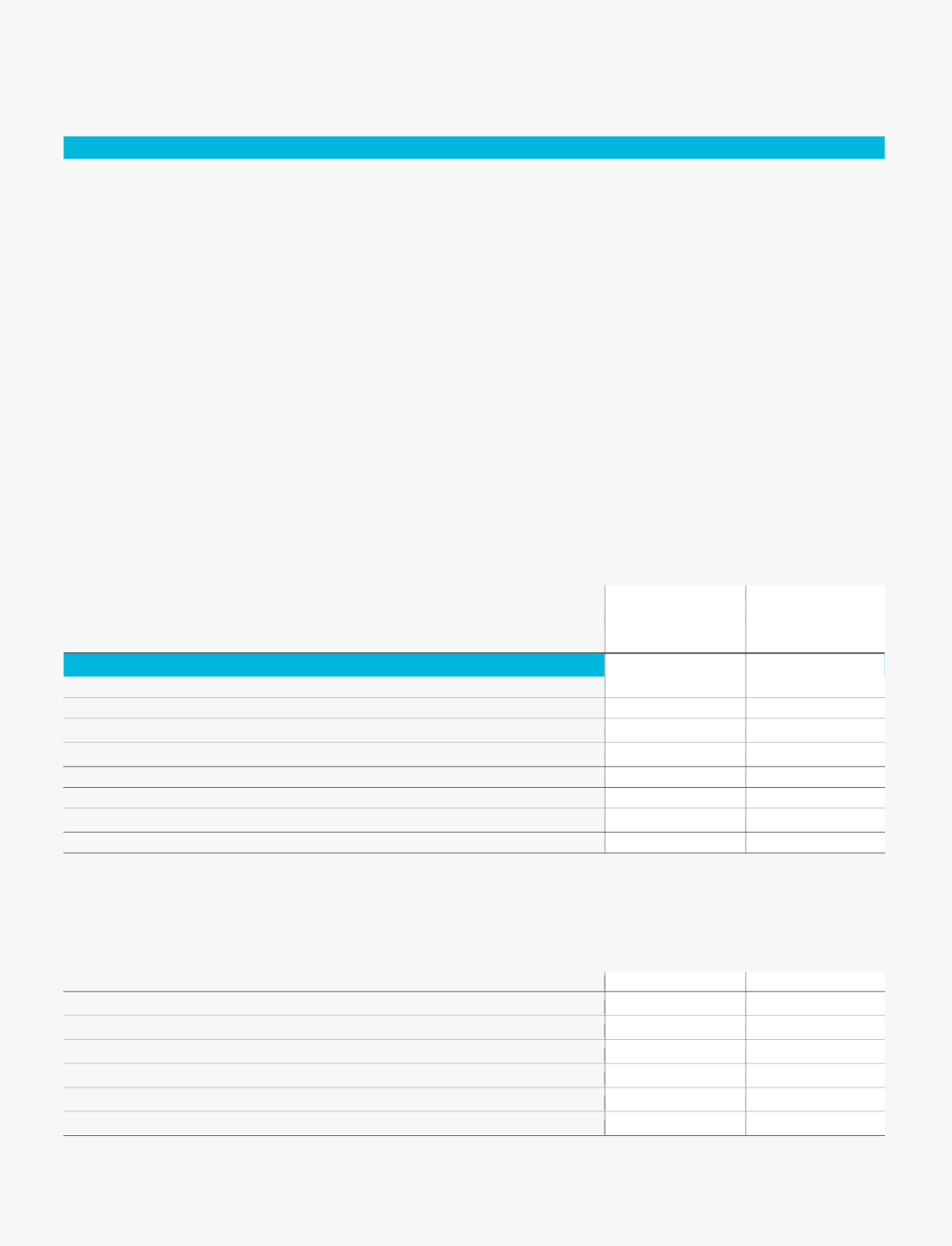

2. SHARE CAPITAL

As at

As at

31.03.2013

31.03.2012

`

in million

`

in million

Equity Share Capital

Authorised

125,000,000 (125,000,000) Equity Shares of par value of

`

2/- each

250.00

250.00

10,00,000 (10,00,000) Preference of Shares of par value of

`

100/- each

100.00

100.00

350.00

350.00

Issued, Subscribed & Paid up

73,583,580 (73,583,580) Equity Shares of par value of

`

2/- each fully paid up in cash

147.17

147.17

147.17

147.17

Name of Shareholder

No. of Shares

% of Shareholding

Kajaria Exports Ltd.

15,283,545

20.77%

Kajaria Securities Pvt. Ltd

6,611,905

8.99%

Pearl Tile Marketing Pvt. Ltd.

5,080,240

6.90%

Cheri Ceramics Pvt. Ltd

5,058,385

6.87%

HSBC Bank (Mauritius) Ltd. A/c Jawalamukhi Investments Holdings

5,777,005

7.85%

Bengal Finance & Investment Pvt. Ltd

4,004,427

5.44%