63

opinion, that prima facie, the prescribed accounts and

records have been made and maintained. We have not,

however, carried out a detailed examination of the same.

10. a)

As per information and explanations given to us

the Company has been regular in depositing the

undisputed statutory dues including Provident Fund,

Investor Education and Protection Fund, Employees

State Insurance, Income Tax, Sales Tax, Wealth Tax,

Service Tax, Custom Duty, Excise Duty, Cess, Octroi,

Entry Tax and other statutory dues with the appropriate

Authorities. There are no undisputed statutory dues at

the year end outstanding for a period of more than six

months from the date they become payable.

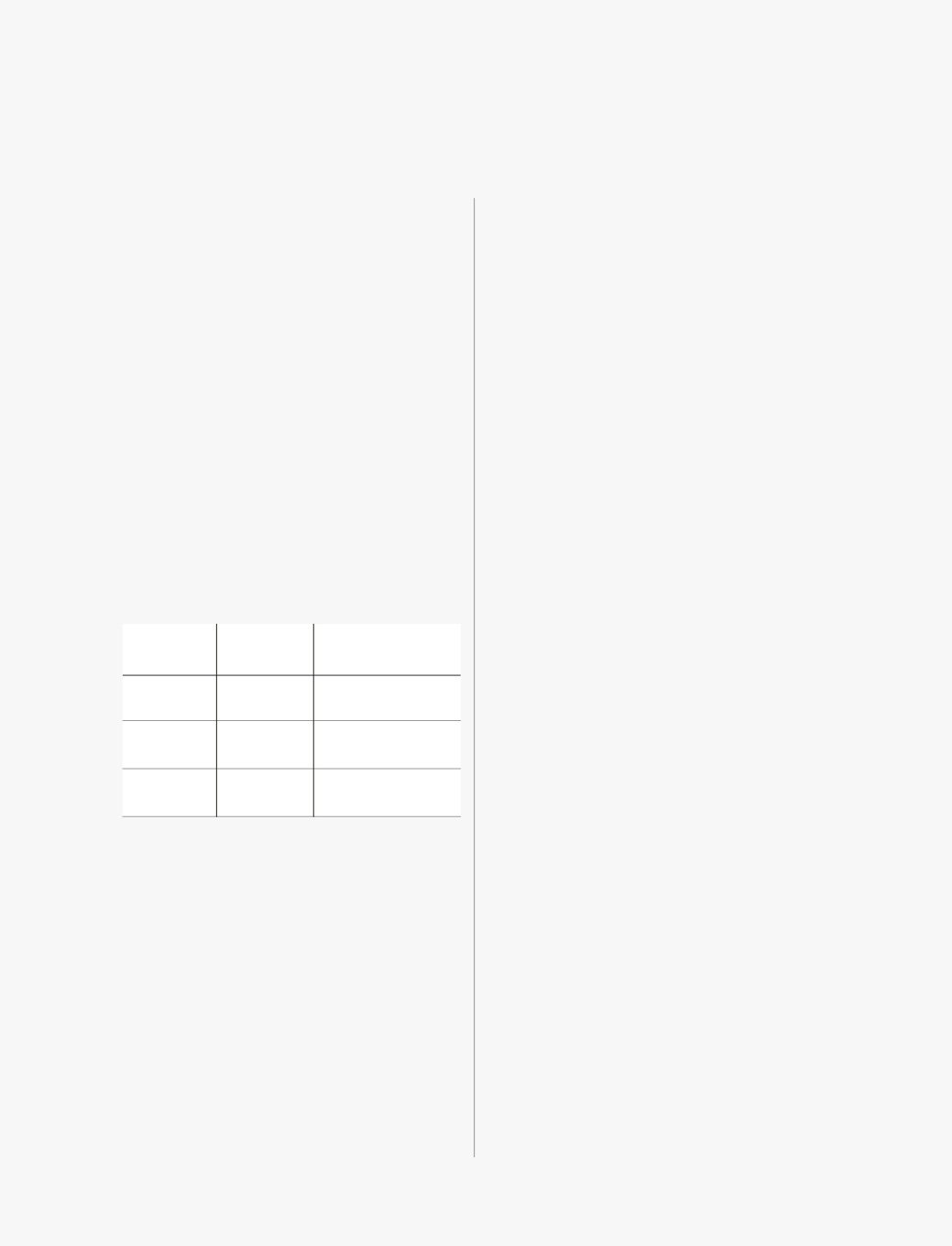

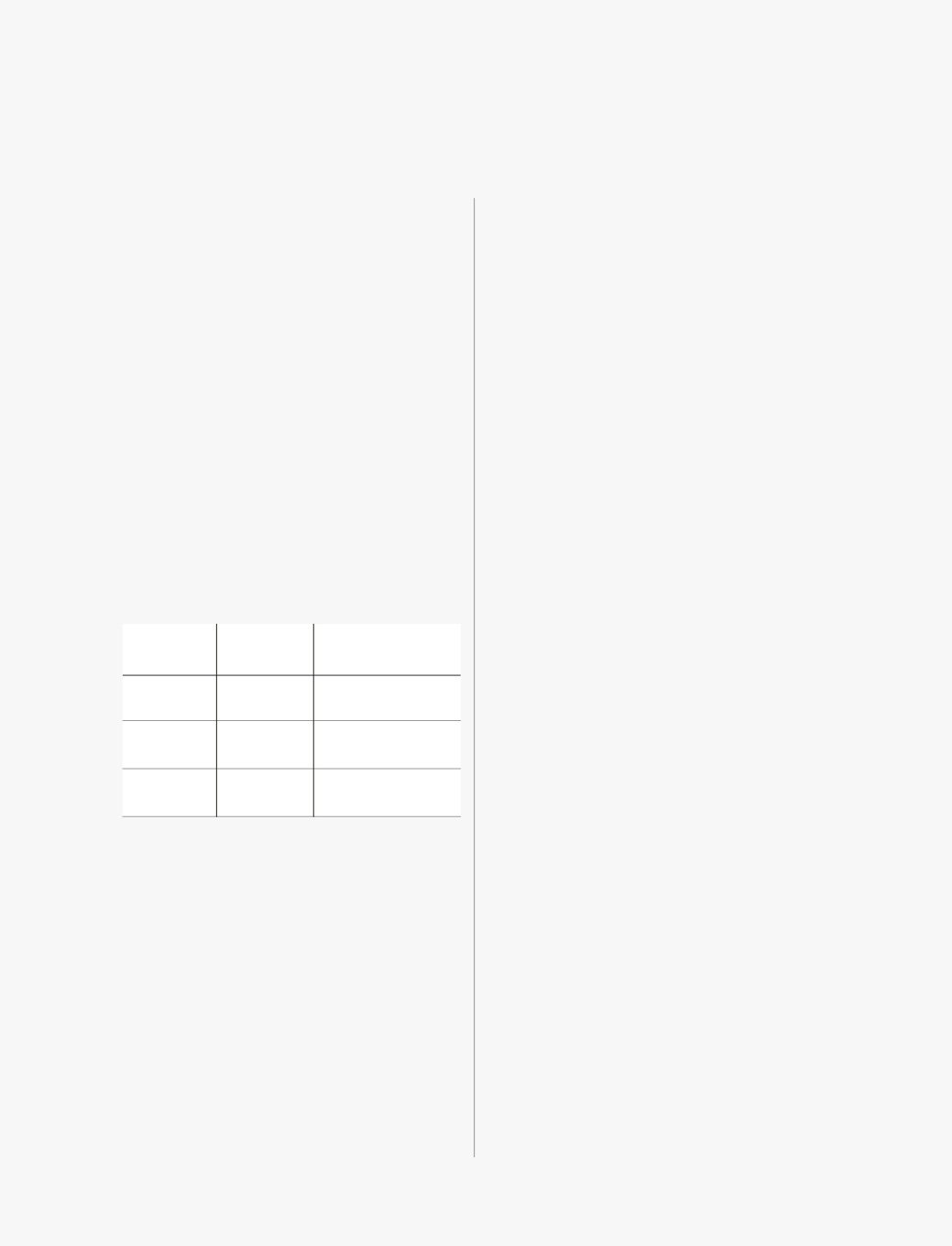

b) We have been informed that disputed demands of

`

57.11 million in respect of Sales Tax and Service Tax

are pending in appeals with the Commissioner Appeals/

High Court as per details below:

Particulars

Amt Demanded

Remarks

(

`

)

Entry Tax

55,538,311

Appeal pending

with Supreme Court

Service Tax

346,927

Appeal pending with

High Court, Rajasthan

Sales Tax Cases

1,224,155

Appeal pending before

Commissioner (Appeals)

11. There are no accumulated losses of the company as at the

end of the year. The company has not incurred cash losses

during the financial year covered by our audit and in the

immediately preceding financial year.

12. Based on our audit procedures and on the basis of information

and explanations given to us by the management, we are of

the opinion that there is no default in repayment of dues to

the Financial Institutions, banks or debenture holders as at

the year end.

13. The Company has not granted any loans and advances on the

basis of security by way of pledge of shares, debentures and

other securities. Hence paragraph 4 (xii) of the order is not

applicable.

14. In our opinion, the Company is not a chit fund/ nidhi/ mutual

benefit fund/ society. Therefore, the provisions of clause

(xiii) of paragraph 4 of the order are not applicable to the

Company.

15. According to information and explanations given to us the

Company has not given any guarantee for loan taken by

others from banks or financial institutions, the terms and

conditions whereof are prejudicial to the interest of the

company.

16. According to the information and explanations given to us

the term loans taken by the Company have been applied for

the purposes for which the loans were obtained.

17. According to the information and explanations given to

us and on overall examination of the Balance Sheet of the

Company, we are of the opinion that the funds raised on short

term basis have not been utilized for long term investment.

18. During the year the Company has not made any preferential

allotment of shares to parties and Companies covered in the

Register maintained u/s 301 of the Companies Act 1956. As

such paragraph 4 (xviii) of the order is not applicable.

19. Since the Company has not raised money by way of Public

Issue during the year paragraph 4 (xx) of the order is not

applicable.

20. Based upon the audit procedures performed and information

and explanations given by the management, we report that,

no fraud on or by the Company has been noticed or reported

during the course of our audit for the year ended 31.03.2013.

21. Other clauses of the order are not applicable to the Company

for the year under report.

For

O. P. Bagla & Co.

Chartered Accountants

Firm Regn No. 000018N

(Atul Bagla)

Place : New Delhi

Partner

Dated : 30 April, 2013

Membership No. 91885