78

Kajaria Ceramics Limited

Annual Report

2012-13

25

YEARSOF

WORKINGWITH

ANATTITUDE

CELEBRATING

March 31, 2013

March 31, 2012

`

in million

`

in million

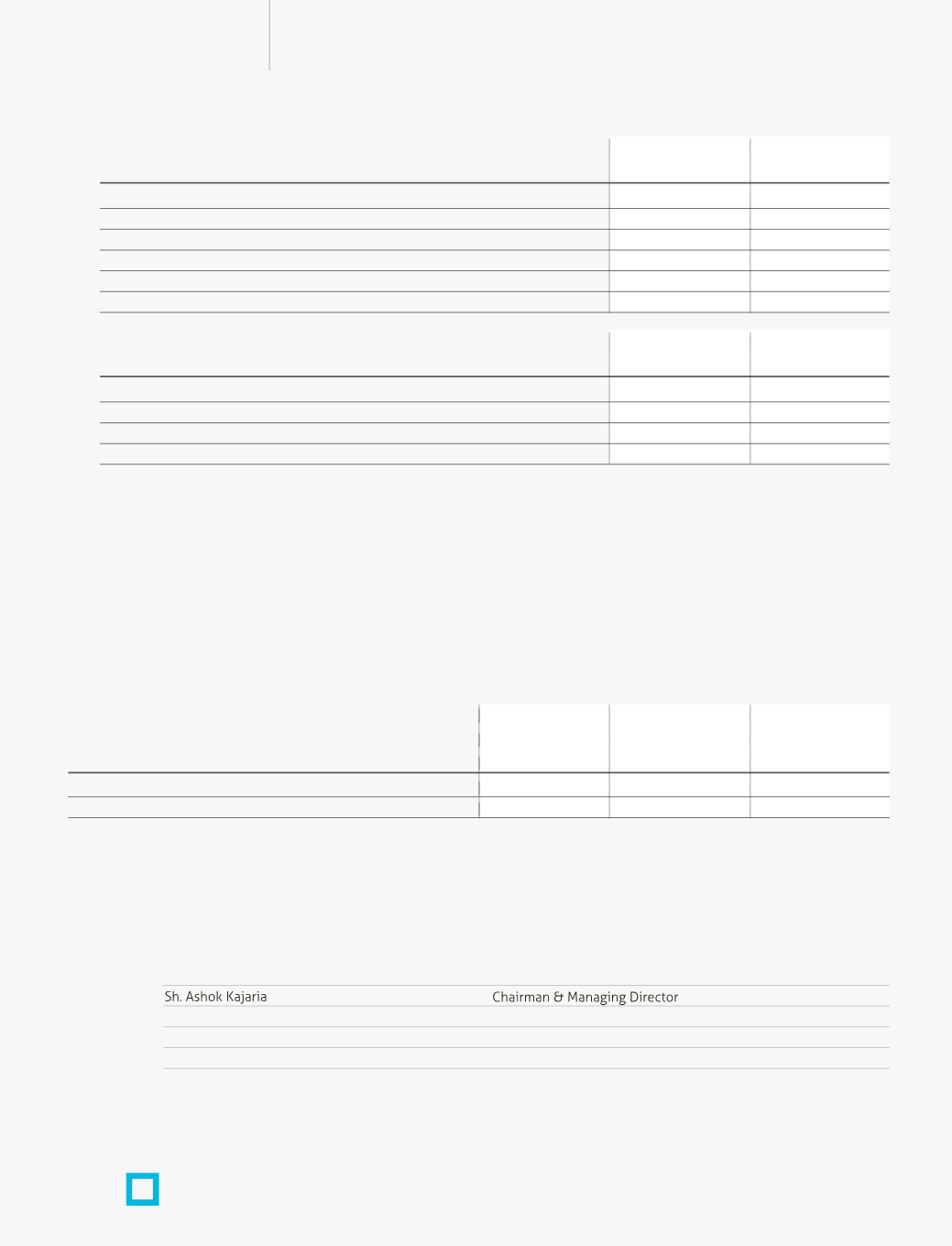

Fair value of plan assets as at 1st April, 2012

24.35

25.60

Return on Plan Assets

2.50

1.12

Contributions by employer

–

1.50

Benefits paid

(2.99)

(3.87)

Actuarial Gains / (losses)

–

–

Fair value of plan assets as at 31st March, 2013

23.86

24.35

Changes in the fair Value of plan assets are as follows:

March 31, 2013

March 31, 2012

%

%

Discount rate

8.25%

8.75%

Expected rate of return on plan assets

8.25%

4.48%

Salary Escalation

7.75%

7.75%

Attrition Rate

1%

1%

The principal assumption used in determining gratuity benefit obligations

for the Company’s plans are shown below:

The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority, promotion and other

relevant factors, such as supply and demand in the employment market.

On consideration of materiality, the entire liability has been classified as a ‘noncurrent liability’.

41. Tax Expense is the aggregate of current year income tax and deferred tax charged to the Profit and Loss Account for the year.

a)

Current Year Charge:

Income Tax provision of

`

451.40 Million has been made on regular income.

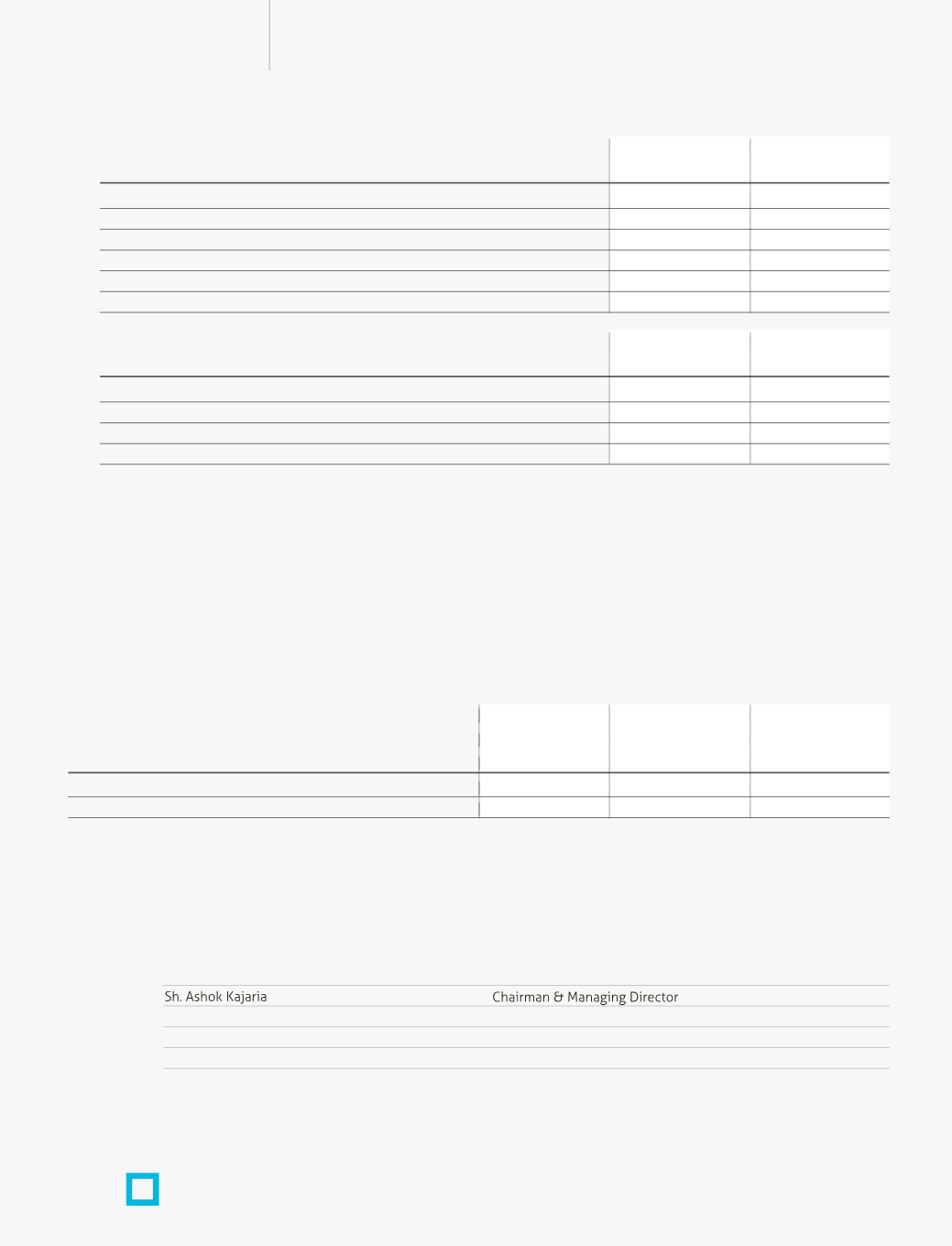

b) Deferred Tax

The Company estimates the deferred tax charge using the applicable rate of taxation based on the impact of timing differences

between financial statements and estimated taxable income for the current year. The movement of provision for deferred tax

is given below:

42.

Related Party Disclosures:

In accordance with the Accounting Standards (AS-18) on Related Party Disclosures, where control exists and where key management

personnel are able to exercise significant influence and, where transactions have taken place during the year, alongwith description

of relationship as identified, are given below:-

A.

Relationships

I.

Key Management Personnel

Name

Designation

Sh. Chetan Kajaria

Joint Managing Director

Sh. Rishi Kajaria

Joint Managing Director

Sh. B.K. Sinha

Director Technical

Opening as at

Charge/(credit)

Closing as at

1st April, 2012

during the year

31st March, 2013

(

`

Million)

(

`

Million)

(

`

Million)

Depreciation

636.28

2.31

638.59

Net Deferred Tax Liability

636.28

2.31

638.59

Notes on Accounts